As the country struggles to come in terms with prevailing cash crunch in the financial system post demonetisation, companies are following innovative ways to ease availability of currencies for their employees.

With the D-Day of November 30 arriving for salary credit, corporates which directly credit payment through electronic mode are facing the least trouble.

Experts are of the opinion that employees of big corporate firms are usually tech savvy and make a lot of digital transactions, making it easier for them to beat cash blues. But, small businesses are the ones struggling to cope with the new dynamics.

Meanwhile, banks have asked companies to give prepaid payment cards in lieu of cash as this will enable employees in doing transactions.

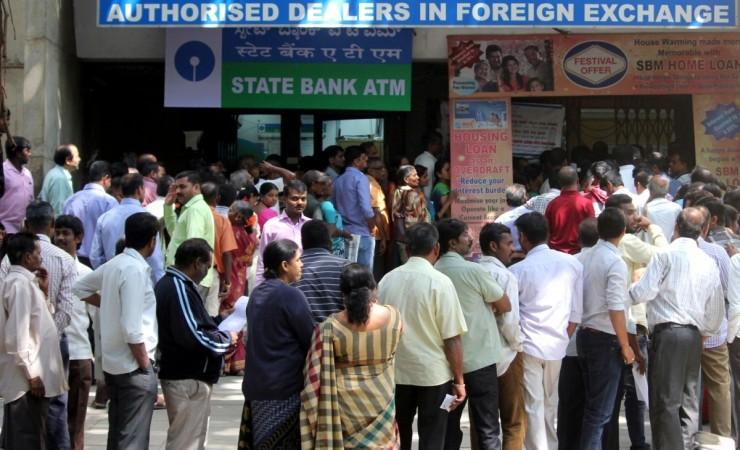

On November 8, the government had announced to demonetise Rs 500 and Rs 1,000 denominations in order to check flow of black money in the system. Since then, the financial system is facing severe cash crunch as demand has outstripped supply of high value currencies.

While around Rs 14.5 lakh crore was sucked out of the system, only Rs 1.5 lakh crore has been pumped into it so far. This has created a peculiar situation when people have money in their bank accounts, but are not able to withdraw it.

Talking on the salary issue, former executive director of Goa Mineral Ore Exporters' Association S Sridhar told International Business Times, India that most of the payment in the mineral-based companies and even in mining sector is done through cheques or through electronic mode. He, however, said truckers employed by third party contractors are facing payment issues as most of the money is paid through cash. "Situation is not different in the mining industry," Sridhar added.

Meantime, the central government had earlier paid its employees in non-gazetted category an advance 'part-salary' amounting to Rs 10,000 in cash on November 23.

Reports also suggested that many small private firms have paid salary in advance to employees in cash. Even some employees in Gujarat were paid one year salary in advance, raising eyebrows on intentions of employers.