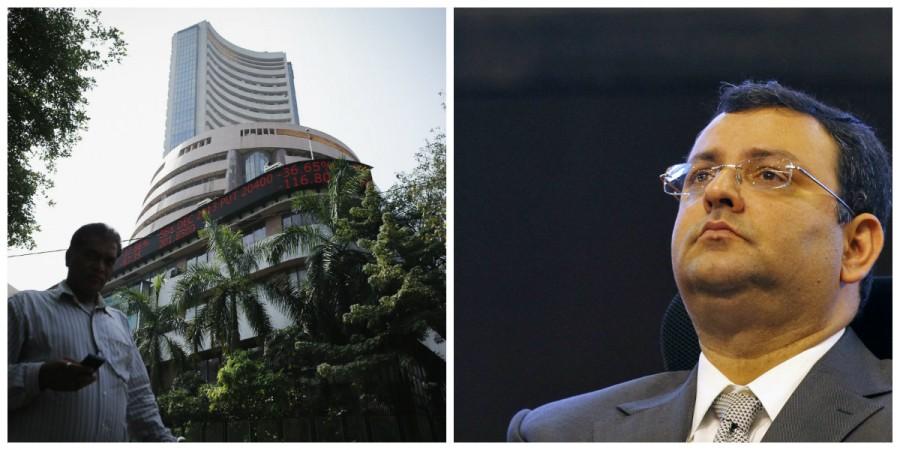

Cyrus Mistry's removal as chairman of Tata Sons on Monday is bound to impact shares of Tata Group companies on Tuesday. The Group, whose market capitalisation was $125 billion on October 6, 2016, has about 30 listed entities including TCS, Tata Steel and Tata Motors that are Sensex heavyweights. Tata Sons, the Group's holding company, appointed Ratan Tata as the interim chief of the company.

Tata Consultancy Services (TCS), which had a market capitalisation of Rs 4,78,390 crore, closed at Rs 2,427.85 on the Bombay Stock Exchange (BSE) on Monday. The entity, which is also India's biggest software services exporter, is the most-valued Indian company.

Tata Motors shares ended 2.67 percent higher at Rs 559.10 apiece, while Tata Steel closed 0.26 percent down at Rs 426.20.

Other listed entities of Tata Group included Voltas, Rallis India, Tata Elxsi, Tata Chemicals, Tata Coffee, Tata Global Beverages, Indian Hotels Company, Tata Communications, Tata Power, Tata Metaliks and Tata Sponge Iron.

In terms of Tata Group turnover, it dropped 4.8 percent to $103.51 billion in 2015-16 from $108.78 billion in the preceding fiscal.

There is speculation that the Shapoorji Pallonji Group has claimed Mistry's removal as "illegal" and likely to challenge the decision of Tata Sons, reported CNBC-TV18. Mistry was appointed the chairman of the company in December 2012.

The BSE Sensex closed 102 points higher at 28,179, led by ONGC, Tata Motors and ICICI Bank.

Foreign institutional investors (FIIs) were net sellers of Indian equities worth Rs 325 crore, according to provisional data published by the National Stock Exchange (NSE). Domestic institutional investors (DIIs) were net buyers of stocks worth Rs 333 crore.