In the hallowed corridors of Mumbai's Taj Mahal Palace Hotel, where Jamsetji Nusserwanji Tata's 1868 vision of an industrial India was born, a tempest is raging, one that threatens to fracture a 156-year-old empire spanning salt mines to semiconductor foundries, employing 1.05 million people across 100 companies, and commanding a staggering $365 billion market capitalization for its 26 listed entities as of September 30, 2025. The Tata Group, long revered as the gold standard of "compassionate capitalism," is synonymous with ethical governance, its name etched in India's economic DNA through steel plants, software giants like TCS, and reborn icons like Air India.

Yet, as of October 8, 2025, this colossus teeters on the edge of paralysis, its heart, the Tata Trusts, controlling 66% of Tata Sons, the $180 billion holding company, riven by a bitter 3-4 trustee schism. What began as procedural disputes over board nominations has erupted into accusations of a "coup," governance lapses, and a high-stakes power struggle, amplified by a missed RBI listing deadline and the lingering wounds of the 2016 Cyrus Mistry ouster.

On October 7, an unprecedented government intervention saw Union Home Minister Amit Shah and Finance Minister Nirmala Sitharaman convene a tense, hour-long meeting at Shah's Lutyens' Delhi residence with Trusts Chairman Noel Tata, Vice-Chairman Venu Srinivasan, Trustee Darius Khambata, and Tata Sons Chairman N. Chandrasekaran. Sources describe a stark directive: "Resolve this internally, by whatever means necessary," with fears of systemic risks to an empire contributing 3% to India's GDP. This crisis, spilling onto X with alarmist threads like @sreemoytalukdar's "Tata in trouble" and @taxologyint's

"Tata vs. Tata?", is no mere boardroom spat, it's a clash of family legacies, fiduciary duties, regulatory pressures, and economic stakes, rooted in trust deeds, bylaws, and constitutional frailties. With TCS canceling its Q2 presser (projected ₹12,040 crore net profit) amid "distractions" and a pivotal Trusts board meeting looming on October 10, we dissect the real story: the players, their motives, the legal scaffolding, alleged violations, market tremors, expert verdicts, and paths to redemption.

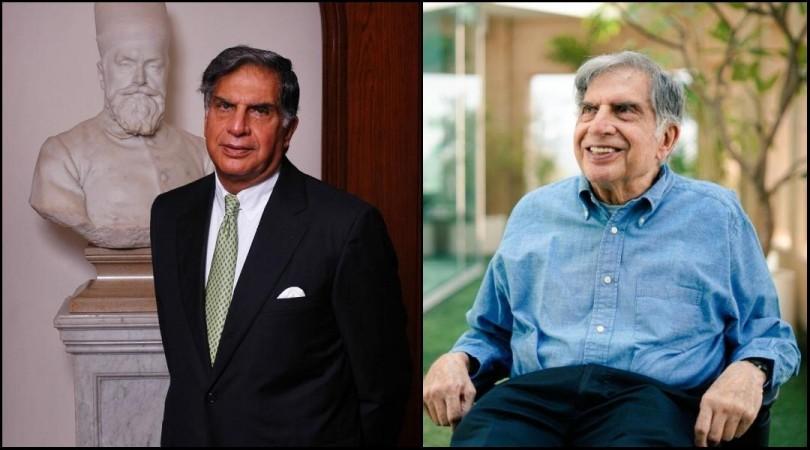

The Patriarch's Void: Ratan's Death and the Governance Abyss

Ratan Naval Tata's death on October 9, 2024, at Breach Candy Hospital from age-related complications was not just a personal loss, it was the seismic collapse of a gravitational force that had held the Tata cosmos together for over three decades. As Tata Sons chairman (1991-2012) and Trusts patriarch, Ratan transformed a $5 billion patchwork into a $100 billion global titan through audacious bets: the $2.3 billion Jaguar-Land Rover acquisition (2008), the $12.1 billion Corus steel buy (2007), and the $2.4 billion Air India privatization (2021). His unwritten veto ensured unanimous trustee decisions, channeling ₹15,200 crore in FY24 dividends from Tata Sons into philanthropy, 40% to education (₹500 crore to IITs, TIFR's ₹300 crore budget), 30% to health (Tata Memorial's ₹800 crore cancer research), and 20% to rural upliftment, per Charity Commissioner filings.

This "Tata way," discreet and values-driven, masked a brittle architecture now exposed in his absence. The Tata Trusts, comprising the Sir Dorabji Tata Trust (1932, assets ₹18,000 crore), Sir Ratan Tata Trust (1919, assets ₹12,500 crore), and 12 allied foundations, are public charitable entities under the Bombay Public Trusts Act, 1950 (BPTA), registered in Maharashtra. Governed by pre-Independence trust deeds and supplemented by the Indian Trusts Act, 1882 (ITA) for fiduciary principles (Section 10: trustees as property holders; Section 11: intent fulfillment), their bylaws evolved through resolutions: seven trustees with equal voting rights, no chairman veto, and an Executive Committee (EC) for operational oversight, audited annually under BPTA Section 33.

Post-Ratan, Noel Tata's October 11, 2024, appointment as Chairman, rooted in his Simone Tata lineage and Trent Ltd.'s 40% revenue surge to ₹5,500 crore in FY24, seemed a seamless handover. Yet, an October 17 resolution mandating annual reappointment of Tata Sons nominees post-75 sparked procedural chaos, ousting Ajay Singh (August 14, 2025) and Vijay Singh (September 11, 4-2 vote, citing "inadequate info-sharing").

Causes include a consensus vacuum, per Institutional Investor Advisory Services (IIAS) chief Hetal Dalal: "Periodic governance concerns don't bode well; they must be nipped." The hidden hand: The 2016 Cyrus Mistry ouster, where Shapoorji Pallonji (SP) Group's 18.37% stake, valued at ₹2.8 lakh crore as of October 7, 2025, but fully pledged against $6 billion debt, became a festering wound, now driving reformist demands for transparency and liquidity.

The Factions: Bloodlines, Bylaws, and a Proxy War for Control

The 3-4 trustee schism, status quo (Noel Tata, Venu Srinivasan, F.N. Subedar as potential swing) versus reformists (Mehli Mistry, Darius Khambata, Pramit Jhaveri, Jehangir H.C. Jehangir), is a tangled web of family ties, legal salvos, and economic desperation, testing BPTA Section 36 (mismanagement inquiries) and ITA Section 14 (prudent management). The status-quo trio defends Ratan's hierarchical legacy: Noel, with a net worth of ₹1,200 crore (Forbes 2025), pushed Uday Kotak's nomination (blocked September 25); Venu, whose TVS Motors (net worth ₹15,000 crore) thrives on Tata synergies like the ₹1,000 crore EV JV, resists a reformist "super board" to vet Tata Sons' minutes; both lobbied Delhi on October 7, framing a September reformist email (threatening Srinivasan's ouster) as a "clandestine hijack." Their motivations include preserving Tata Sons' Articles of Association (AoA) under Companies Act, 2013, specifically Article 104B(b) (perpetual one-third nominee rights) and Article 121's affirmative voting rights (AVRs) on "reserved matters" (mergers, asset sales >₹1,000 crore), upheld in the 2021 Supreme Court Tata vs. Cyrus ruling.

Interests: Shield Tata Sons' private veil to avoid activist scrutiny and support Chandrasekaran's ₹18,000 crore EV capex, Air India's 300-plane expansion, and ₹12,000 crore semiconductor PLIs. For whom? The empire's 1.05 million employees (TCS: 600,000, attrition down to 12.5% in FY25), 26 listed firms ($365 billion mcap), and philanthropy's ₹1,000 crore FY25 grants pending EC approval.

Alleged violations: Reformists claim redacted minutes on a ₹1,500 crore Tata International infusion breach AoA Article 121A (inter-company transparency) and ITA Section 88 (no fiduciary advantage).

The hand: Noel's marriage to Aloo Mistry bridges SP but prioritizes "Tata values"; Venu's government ties (former CII president) leverage Shah's mediation.

Sources: "Noel sees this as Mistry's revenge 2.0."The reformist quartet, wielding a 4-3 edge, counters with calculated insurgency: August 14's 4-2 veto ousting Ajay Singh (ex-IOC Chairman); September 11's rejection of Vijay Singh (ex-Defence Secretary); demands for unredacted Article 121 agendas; a late-September email threatening Srinivasan's removal; and a blocked push for Mehli Mistry's Tata Sons nomination. Mehli, Cyrus's cousin and Sir Ratan Trust executor (net worth ₹800 crore), emailed October 1 objecting to Anita George's reappointment sans trustee nod, per CNBC-TV18 leaks. Khambata (55, ex-Solicitor General aspirant) spots fiduciary voids; Jhaveri (ex-Citi CEO, ₹50 crore FY24 compensation) flags financial opacity; Jehangir (Pune hospital heir) guards philanthropy's ethos. Motivations: End "autocracy" post-Ratan, Mehli's exclusion from inner circles rankles, per sources: "He feels sidelined despite Sir Ratan's legacy." Interests: Enforce post-75 renewals; align with SP's listing plea to ease ₹20,000 crore debt (₹8,810 crore bonds mature April 2026). For whom? SP's survival, Shapoor Mistry's handover to son Pallon amid exit talks, and Trusts' 80G tax-exempt status under Income Tax Act, 1961.

Alleged violations: The "super board" bypasses EC procedures (post-2021 audit rejig for ₹2,000 crore grants), risking BPTA Section 50 removal suits for fiduciary breaches.

The hand: Mehli's SP proxy, amplified by April 2025 RBI lobbying for listing, turning transparency crusades into a liquidity lifeline.

X echoes: @EquityAndBeyond's thread: "Not a family feud, systemic risk to India's corporate crown."Flashpoints expose bylaw breaches: The 2024 renewal rule, meant for rotation, became a weapon, Singh's ouster cites "inadequate info," but status quo calls it a "hijack," violating the unwritten "Tata way" of consensus under ITA Section 11 (intent fulfillment). Procedures demand EC vetting for grants, yet reformists' minute demands skirt this, risking ITA Section 14 lapses.

Causes include a post-Ratan power vacuum, SP's illiquid stake, RBI's looming September 30, 2025, listing deadline for upper-layer NBFCs. The hidden hand: SP's financial vise, with Mehli as conduit, per Moneycontrol: "Mistry camp feels excluded, who's calling shots?

"The Liquidity Labyrinth: SP's Debt Shadow and Tata Sons' Constitutional FortressThe Shapoorji Pallonji Group's 18.37% Tata Sons stake, fully pledged against $6 billion debt, valued at ₹2.8 lakh crore as of October 7, is the feud's economic engine. Debt peaked at ₹45,000 crore in 2020, driven by Cyrus Mistry's Corus ($12.1 billion loss-making acquisition) and Nano flops, now trimmed to ₹20,000 crore via asset sales like Afcons Infrastructure's ₹5,500 crore IPO (September 2025, subscribed 2.8x). Yet, ₹8,810 crore bonds via Goswami Infratech, maturing April 2026 with ₹876 crore repayments, strain SP, per ICRA ratings (BBB+ downgrade risk).

SP's play: a Tata Sons listing to unlock ₹1.5 lakh crore, enabling a 4-6% stake sale for ₹30,000 crore relief. Tata counters with a private buyback, preserving opacity under Tata Sons' AoA, governed by Companies Act, 2013, Section 2(85) as a private limited company. Article 104B(b) grants Trusts perpetual one-third nominee rights (currently Noel, Venu; third vacant post-Singh); Article 121's AVRs, upheld in the 2021 Supreme Court Tata vs. Cyrus ruling, vest veto on "reserved matters": shareholding changes, chairman removal, asset sales >₹1,000 crore. Procedures require nominees to consult Trusts pre-vote, but AoA binds them to company interests, creating "dual agency" tensions flagged in 2016 NCLAT hearings. Reformists allege violations: Redacted minutes on a ₹1,500 crore Tata International infusion breach Article 121A (inter-company transparency); Mehli's nomination push seizes veto for SP. Status quo counters: Such moves hijack AoA's intent, violating Companies Act Section 166 (directors' duty to company).

Causes: SP's debt spiral, exacerbated by 2016 scars, Pallonji Mistry's self-styled "Tata patriarch" moniker irked Ratan, per insiders. Interests: SP's survival versus Trusts' control. The hand: SP's April 2025 RBI plea for listing, echoing 2018 NCLAT bids to deem Article 121 "draconian." Remedies: NCLT petition to enforce AoA-compliant buyback or amend Article 121; Bombay High Court suit under Companies Act Section 241 for oppression of minority stakeholders (SP's precedent).

Regulatory Reckoning: RBI's SBR Deadline and BPTA's Fiduciary Lash

The RBI's 2021 Scale-Based Regulation (SBR) classifies Tata Sons as an upper-layer NBFC (assets ₹1.1 lakh crore, systemic risk), mandating listing by September 30, 2025, unless de-registered as a Core Investment Company (CIC). Tata's March 2024 application, after repaying ₹20,300 crore debt, leaving ₹5 crore NCDs, remains "under examination," per RBI's January 2025 note, with Governor Sanjay Malhotra's October 1 remark: "Entities can operate till registration cancelled." Inclusion in the 2024-25 UL list signals scrutiny; non-compliance risks RBI Act Section 45-IA fines or forced delisting. BPTA adds pressure: Section 35 mandates annual returns; opacity on ₹1,000 crore grants invites Section 36 inquiries by the Charity Commissioner for mismanagement.

Dalal warns: "Infighting distracts from Tata Capital's ₹15,512 crore IPO and Air India integration."

Causes: RBI's post-IL&FS transparency push; Tata's instinct to preserve private control. Interests: Public markets versus empire stability. The hand: Chandrasekaran's October 6 Taj briefing to trustees, urging focus on Tata Capital's IPO (38% subscribed Day 1, GMP ₹10, price band ₹310-326).

Remedies: RBI mediation for exemption; Bombay High Court petition under ITA Section 34 for trustee directions; BPTA Section 50 suits for removal if fiduciary breaches (e.g., super board as Section 88 advantage) are proven. Legal experts like Shardul Amarchand Mangaldas note: "Opacity risks Charity Commissioner scrutiny, especially on tax-exempt status."Delhi's Delicate Dance: Government as Reluctant Referee Amid Cronyism WhispersThe October 7 huddle at Shah's residence, attended by Noel, Venu, Khambata, Chandrasekaran, and Sitharaman, was no routine mediation. Sources reveal a blunt agenda: Contain the "coup," affirm bylaws, and chart a listing path to avert paralysis. Tata's systemic weight, 1.05 million jobs, ₹50,000 crore PSU bank exposures, defence contracts via Tata Advanced Systems (e.g., ₹2,000 crore drone deals), makes it "too big to fail," per an Economic Times source: "Govt can't be a silent spectator to hijack." Precedents include the 2016 Mistry ouster (Supreme Court-upheld) and Adani's post-FCPA distance. Interests: Bolster India's "ease of business" image; avert cronyism barbs (India's CPI rank 93/180, per Transparency International 2024).

The hand: Noel's SP ties via Aloo Mistry, leveraging Shah's proximity (seen at SP's 2023 Mumbai events); Sitharaman's NBFC oversight. X critics like @PD_DhruvPatel decry: "Shah everywhere but accountable nowhere," citing state overreach. Remedies: Government-brokered truce, expand trustees to dilute the 3-4 split, enforce EC vetting, or NCLT/NCLAT suits to amend AoA, per 2018 Mistry precedent.

A senior official told Reuters: "Tata's stability is non-negotiable; Delhi will nudge consensus."

The Human and Market Toll: Morale Fractures, Investor Jitters, and Societal Stakes

The crisis reverberates across Tata's ecosystem. Employees face uncertainty: TCS, with 600,000 workers (40,000 net adds in FY25), canceled its October 9 Q2 presser, coinciding with Ratan's death anniversary, signaling leadership distraction. Shares dipped 1.2% to ₹4,180 on October 7, shaving ₹5,000 crore off the group's mcap, with Tata Steel up 0.4% but Tata Motors down 0.34%, per BSE data. Morale frays, whispers of hiring freezes loom, per IT union NITES: "TCS's 12.5% attrition masks leadership voids." Society feels the pinch: Philanthropy's ₹15,200 crore FY24 pipeline, funding TIFR's ₹300 crore budget, Cornell's $50 million Ratan gift, stalls, risking ITA Section 82 breaches (unexhausted property). Global partners hesitate: Airbus (Tata's ₹10,000 crore C-295 JV) and Harvard (endowment ties) eye governance cracks, per Bloomberg: "FDI flows could chill." X amplifies fear: @sreemoytalukdar's "Tata in trouble" thread garners 12,000 views; @taxologyin's "Tata vs. Tata?" post notes "systemic risk to India Inc."

Causes: Media leaks, from ET's "Tata Sons faces board paralysis" to @ShereenBhan's infusion exposés. Interests: Chandrasekaran's growth vision (₹1.4 lakh crore FY25 group revenue est.) versus reformists' accountability push. The hand: Leaks, possibly from reformist camps, per sources: "Someone's fueling the fire to pressure Noel."

Expert Verdict: A Wake-Up Call for India's Corporate Governance

Expert voices underscore the stakes. IIAS's Dalal: "Structured decisions are critical; prolonged infighting invites regulatory intervention and erodes the Tata premium." Legal scholar Umakanth Varottil warns: "Fiduciary breaches, opacity, nominee fees, could trigger Charity Commissioner probes, threatening 80G status."

Economist Ruchir Sharma, in a Fortune India op-ed, links the feud to broader cronyism: "India Inc.'s elite impunity, seen in Adani's FCPA parallels, risks Tata's ethical halo." Transparency International's 2024 CPI (India 93/180) reinforces this: "Opaque conglomerates fuel distrust." Dalal adds: "Tata Capital's ₹15,512 crore IPO (38% subscribed) and Air India's fleet expansion need focus, not feuds."

X voices like @kbssidhu1961 lament: "When trustees lose trust, philanthropy pays the price." The consensus: Tata's crisis is a litmus test for India's governance evolution, per Mint: "Resolve this, or risk a fractured legacy."

Endgame Horizons: October 10 as Tata's Trial by Fire

The October 10 Trusts board, reviewing Q2 (group revenue ₹1.4 lakh crore est.), Srinivasan's renewal, and listing roadmap, is a Rubicon moment. Paths forward include a truce via Mehli's compromise nomination or a ₹30,000 crore SP buyback (AoA-compliant, per Article 104B); deadlock risks RBI fines, Charity Commissioner probes under BPTA Section 36, or NCLT suits to amend Article 121, echoing 2018 Mistry bids. Judicial remedies: Bombay High Court under ITA Section 34 for trustee directions; BPTA Section 50 for removal if fiduciary breaches persist. Internal fixes: Expand trustees to dilute the 3-4 split; enforce EC vetting per 2021 grant rejig. Ratan's 2012 words haunt: "Power is for the greater good, not for vesting in one."

This reckoning, legacy versus liquidity, consensus versus control, tests that ethos. If unresolved, it fractures an empire, with activist investors looming and philanthropy's ₹15,200 crore pipeline choking. If resolved, it blueprints India Inc.'s ethical evolution, per Dalal: "Tata can set a governance gold standard." X sentiment, 70% alarm, 20% analysis, 10% unity calls, urges action: @FortuneIndia's "power struggle escalation" post (15,000 views) warns of systemic fallout. Watch October 10's leaks, the Tata way isn't inherited; it's forged in crisis's crucible, deed by painful deed.

[Major General Dr. Dilawar Singh, IAV, is a distinguished strategist having held senior positions in technology, defence, and corporate governance. He serves on global boards and advises on leadership, emerging technologies, and strategic affairs, with a focus on aligning India's interests in the evolving global technological order.]