State Bank of India's decision to cut the interest rate on savings accounts of less than Rs 1 crore, has come in for praise from Finance Minister Arun Jaitley, who said the move was in sync with the reduction in lending rate.

Responding to a Zero Hour question in the Parliament, he said the government has already floated a deposit scheme to protect the interests of senior citizens that guarantees 8-plus percent interest rate.

The high-interest rate on savings and fixed deposits was during a time when inflation was 10-11 percent and sluggishness was setting in. When the lending rate came down, so did savings account, Jaitley said.

Prime Minister Narendra Modi had announced the Pradhan Mantri Vyaya Vandana Yojana (PMVYY) in December last year which was launched in May. "The effective rate comes to 8.3 percent," he said, adding that the scheme is managed by LIC.

Also read: State Bank of India shares spurt after lender cuts interest rate on savings deposits

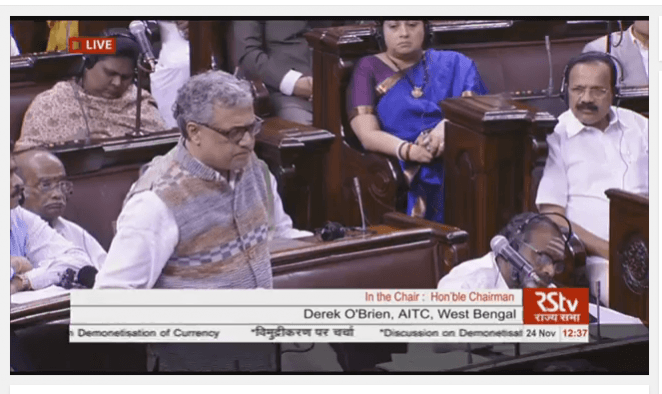

Earlier, All India Trinamool Congress (AITMC) lawmaker Derek O'Brien raised the issue through a Zero Hour mention, saying 90% of savings bank deposits are of less than Rs 1 crore and the move to cut the interest rate has affected the small depositors, senior citizens and pensioners the most.

Fixed deposit rate three years ago was 9-10 percent, which has now fallen below 6%, O'Brien elaborated. "This decision will increase infiltration of chit funds," he argued.

O'Brien said the government is not able to recover Rs 7 lakh crore NPA with big corporations and is hurting common people with such decisions.

Jaitley countered the NPA argument saying, the NPA issue can be discussed when a banking amendment bill comes up for debate in the House.

Naresh Agarwal from Samajwadi Party (SP) said not just the savings bank interest rate, but small savings schemes, PF, Kisan Vikas Patra, senior citizen deposits and PPF have also been reduced.

Another SP MP, Chandrapal Singh Yadav raised the issue of villagers not getting compensation for agriculture land and their residential plots being taken away by army cantonment.