Imagine 2032. What's scarier?

A) Investing in the stock market

OR

B) Missing out on Rs 40 lakh in gains since you sidestepped stocks 15 years ago.

It's a safe quess that you ticked option B!

The Young Indian, who is intent on building a New India, cannot afford to make the same old mistakes. Millennials often fear stocks because prices sometimes plummet. Episodes like 2008 (when the markets crashed 50 percent) seemed to have transfixed their collective financial gaze to the ground when it comes to experimenting with stocks as long-term investments.

When it comes to retirement savings, young Indians and millennials are courting a big financial risk by avoiding stocks altogether. Simply put, not investing in stocks comes at a big opportunity cost.

Consider the math: A 25-year-old who saves Rs 1.50 lakh a year in a public provident fund (PPF) would accumulate about Rs 45 lakh by the time she or he hits 40 years of age. PPF is a safe investment option, trusted by many. An attractive interest rate of 7.8 percent currently, which is fully exempt from Income Tax under section 80C, for a tenure of 15 years or even more, and the window to deposit a maximum Rs 1,50,000 in a financial year makes PPF very popular.

PPF or any other debt investment option avoids equities by definition.

Unfortunately, by avoiding stocks, the 25-year-old would be making a big mistake. If she was to invest the same Rs 1.50 lakh a year in tax-saving mutual funds or unit-linked insurance plans that invest in equities, they could easily get a return of 15 percent annually over a 15-year-period. In the last 15 years, most MFs have given returns between 13.5 percent to 30 percent annually. Such returns of 15 percent, though not guaranteed -- unlike in PPF --, would take them to Rs 85 lakh. That's Rs 40 lakh more than returns via the PPF route.

If you invest the money in tax-saving bank fixed deposits, that would fetch you an interest rate of 6-6.5 percent. This means that savings of Rs 1.50 lakh annually for 15 years would fetch you Rs 38 lakh, which is lower than PPF and definitely lower than stock-linked investment products.

Clearly, the opportunity cost of leaving a sum that large on the table is a bigger risk to millennials and young earners than stock market volatility.

While it's true that stocks swing up and down and volatility can be a fearsome prospect for many, returns from equities over a long-term period are not negative, especially if you invest in a portfolio of large and top quality companies. For instance, the portfolio of top 50 stocks traded on the National Stock Exchange have given about 8 percent returns annually over last 10 years. In the last five years, this portfolio has given over 12.5 percent.

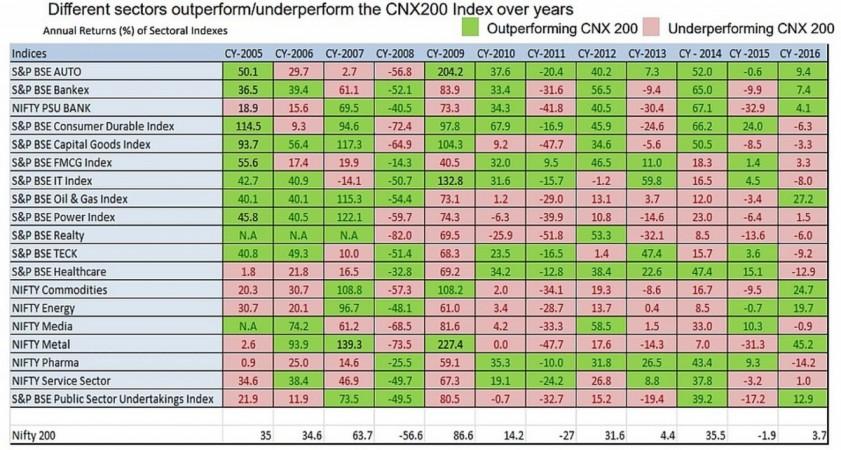

Take a look at the chart below to see how a collection of top 200 stocks (CNX 200) and sectoral benchmarks have performed over the last few years. While they have no doubt seen their ups and downs, at the end of the day, remember that negativity does not linger on forever; or, with anybody.