The biggest metropolitan cities in the United States are way too expensive for the average worker in the country, surveys show.

One recent report by Interest.com found that a median-income earner can afford a median-priced home in only 10 of the 25 largest metropolitan areas in the U.S.

While this year's report is better than last year's when only 8 of the 25 areas were affordable, it is still below the 2012 report when 14 of the 25 major regions were within the means of an average US household.

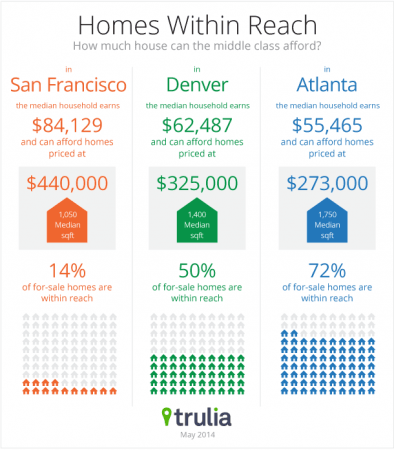

A separate report by Trulia showed that in the 20 richest metros of the country, only 47 percent of the homes were affordable for the rich.

The Trulia report also showed that California was the most "unaffordable" state with San Francisco topping the list of the most expensive areas. Only 14 percent of the homes for sale in Frisco were affordable.

The Interest.com report also echoed Trulia's survey showing San Francisco as the most expensive area. The city's median income was 46 percent lower than the income required for buying a median-priced house in the area.

Coldwell Banker Residential also recently released their annual home listing report and found that the difference between the most expensive and least expensive markets is $1.9 million!

Below are the most expensive markets of the United States:

Most Expensive Markets to Buy a Home

1) Los Altos, Calif. – average listing price: $1,963,100

2) Newport Beach, Calif. – average listing price: $1,904,083

3) Saratoga, Calif. – average listing price: $1,867,980

4) Redwood City / Woodside, Calif. – average listing price: $1,430,329

5) Los Gatos, Calif. – average listing price: $1,307,408

However, the Trulia report did underscore that in 80 of the 100 metro areas, homes were still affordable for the middle class. About 50 percent of the homes for sale in Denver were affordable while a little over 70 percent of the homes listed were affordable in Atlanta.

The coming year is expected to be in favour of the buyers. More sellers are listing their homes hoping to find the right bargain. Buyers, on the other hand, are cautious and are waiting for prices to fall further before taking the final property decision.

The market is also evolving to accommodate buyers. Mortgage rates have been at record lows with the 30-year fixed rate hovering at 4 percent. Lenders are loosening credit standards and the jobs scenario is also improving.

"The narrowing gap between home buying and home selling sentiment may foreshadow increased housing inventory levels and a better balance of housing supply and demand. These results may help drive a healthier housing market in 2015." Doug Duncan, chief economist at Fannie Mae stated.

"...in the face of broader improvement in economic sentiment. The share of consumers who expect their personal finances to get better is near its highest level since the survey's inception, while those expecting their finances to get worse reached a survey low," Duncan added.