Samsung's dominance in the Indian smartphone market is not new, and it continues to rule the segment, beating other mobile phone vendors like Micromax, Lenovo, Intex and Reliance Jio in terms of total units sold in Quarter 2 of 2016. A finding by the International Data Corporation (IDC) has found that the South Korean technology giant is still the market leader in the Indian smartphone industry.

According to IDC, a firm that provides market intelligence, Indian smartphone market registered shipment of 27.5 million units of smartphones in CY Q2 2016, posting a 17.1 percent growth over the previous quarter and a marginal 3.7 percent growth over Q2 2015. It has come as a breather as Indian smartphone market showed declined performance for two successive quarters.

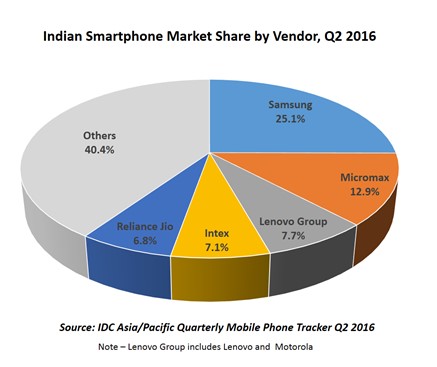

Samsung leads the pack with 25.1 percent share in the Indian smartphone market, registering 10.9 percent sequential growth over the previous quarter and 15 percent growth from the same period last year. It is followed by Micromax with 19.9 percent growth over the previous quarter, and 12.9 percent share in the market.

Lenovo Group (including Motorola) is in the third position with 7.7 percent market by posing a 10.3 percent growth over the last quarter. Intex has slipped to the fourth position in Q2 2016 as its shipments dropped 9.8 percent sequentially and 30.1 percent over last year. Its present share in Indian smartphone market is 7.1 percent.

Reliance Jio is the fifth largest smartphone vendor with 12.3 percent sequential growth in Q2 2016. Its current share in the Indian smartphone market is 6.8 percent. The rest of the vendors account for 40.4 percent of smartphone market share in the country.

"China based vendors' shipments grew 28 percent over previous quarter of which Lenovo group, Vivo, Xiaomi, OPPO and Gionee were key contributors driving the growth," Karthik J , Senior Market Analyst, Client Devices, IDC India, said in a statement. "Until now, Lenovo was the only China based vendor to ship over a million units in a quarter, while this quarter saw additional three vendors joining the million shipments bandwagon."

"Sub $150 segment has been a strong foothold for Indian vendors, which is now facing increased pressure from both global and China based vendors," Jaipal Singh, Market Analyst, Client Devices, IDC India, said. "Aggressive entry of Reliance Jio with shipments of over a half a million 4G devices has captured significant share in sub $50 segment at the expense of other Indian vendor's share."

Surprisingly, Xiaomi has failed to make it to the list of top five leaders in Indian smartphone market though the study found that the "Redmi Note 3 was not only the top selling model in online channel but also a star product for the vendor contributing majority of Xiaomi's total shipments in Q2 2016."

Apple has failed to make an impact in Indian market despite the release of iPhone SE. Market research firm Strategy Analytics had earlier said in its report that Apple sold only 0.8 million iPhones in the Q2 2016 in India compared to 1.2 million units sold in Q2, 2015. This means the company's share in Indian smartphone market has dropped to 2.4 percent from 4.5 percent in Q2 2015.