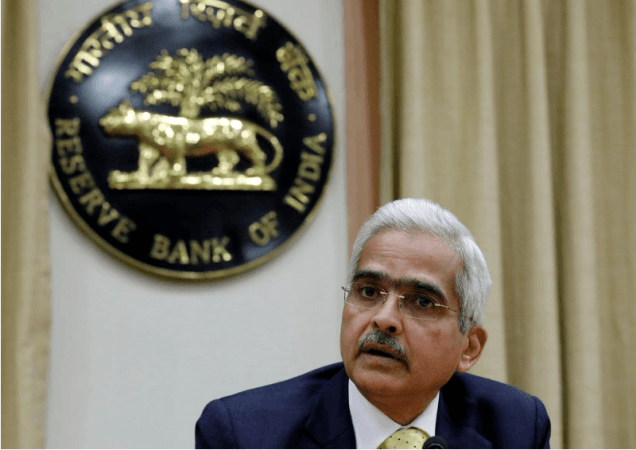

Reserve Bank of India Governor Shaktikanta Das announced 35 basis points rake hike in its bi-monthly monetary policy meeting today. The rate hike was primarily aligned with market expectations of a 25-35 basis points hike.

The repo rate now stands at 6.25% from 5.90% amid inflationary pressure, geo-political uncertainty and the risk of looming recession. The standing deposit facility (SDF) rate stands at 6.00% and the marginal standing facility (MSF) rate and the Bank Rate stand at 6.5%.

This year RBI has hiked repo rates five times so far, starting from 40 basis points in May, followed by three successive 50 basis points rate hikes in the last three MPC meetings and 35 basis points in the December policy meeting.

"The global economy is still marred by profound shocks and unprecedented uncertainty. Mixed signals are emanating from the geo-political situation and financial market volatility. The war in Ukraine overwhelmed the world in a black swan moment and fundamentally altered the global economic outlook. In this hostile international environment, the Indian economy remains resilient, drawing strength from its macroeconomic fundamentals." Das said.

The RBI remains focused on the withdrawal of accommodation as the CPI inflation still remains higher than RBI's upper tolerance band of 6% for 10th consecutive month. The committee is of the opinion that inflation is expected to remain higher than 4% over the next 12 months and further calibrated monetary intervention is required to keep inflation expectations anchored and bring down persistently high core inflation.

"Pressure points from high and sticky core inflation and exposure of food inflation to international factors and weather-related events do remain. While being watchful of the impact of our earlier monetary policy actions, will keep Arjuna's eye on the evolving inflation dynamics and be ready to act as may be necessary." Das said.

The headline inflation is expected to be 6.6% in the third quarter (October to December) and decline to 5.9% in the fourth quarter. Inflation is expected to come under the upper tolerance band of 6% from the next quarter.

Monetary Policy Committee (MPC) concluded in today's policy meet that the growth prospect of the Indian economy is resilient and the inflation is expected to moderate but said the fight against inflation is not over and the future course of monetary policy will depend upon new data, the evolving outlook of the economy and past policy actions.