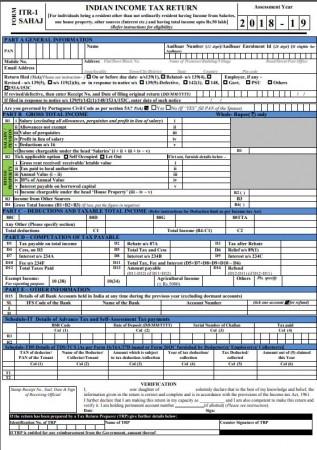

As the citizens of India gear up to file their income tax returns (ITR) for the assessment year 2018-19, the Central Board of Direct Taxes (CBDT) has notified a new ITR form.

As per the sections in the new form, it will be compulsory for salaried taxpayers to declare the break-up of their salary, while businessmen will be required to fill in their Goods and Services Tax identification number (GSTIN) and their annual turnover. However, the CBDT clarified that these aren't major changes and the other processes remain the same.

The ITRs can still be filed online except in some categories, the Press Trust of India quoted a statement by the CBDT.

While the forms until now sought the taxpayers' salary amount in full, this time the ITR forms has rows for the specified break-up. The salary/pension section has now been divided into sub-categories such as allowances that are not exempt, the value of perquisites, profit in lieu of salary and deductions under section 16.

The CBDT said the ITR-1 can be filed by an individual who "is resident other than not ordinarily resident and having an income of up to Rs 50 lakh and who is receiving income from salary, one house property or other interest income."

The spokesperson for the CBDT also said that the income from property has been rationalized. "Further, the parts relating to salary and house property have been rationalized and furnishing of basic details of salary (as available in Form 16) and income from house property have been mandated," CBDT spokesperson Surabhi Ahluwalia added.

A few changes have also been introduced to the ITR-2 for individual taxpayers and Hindu Undivided Families with income under other heads. "The individuals and HUFs having income under the head business or profession shall file either ITR-3 or ITR-4 in presumptive income cases," the statement added.

As was the case last year, the taxpayers will also have to fill in their PAN and Aadhaar numbers. The last date for filing the ITR is July 31.