India has signed the Organisation for Economic Co-operation and Development (OECD) multilateral convention to implement measures to prevent shifting of profits by companies to low-tax nations to avoid paying taxes.

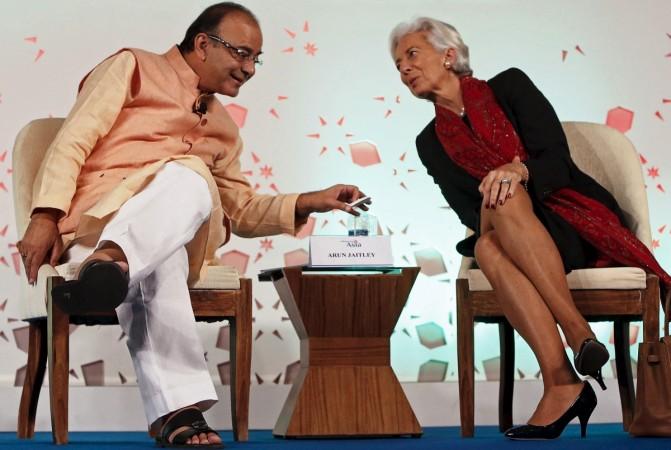

"The multilateral convention to implement tax treaty-related measures to prevent Base Erosion and Profit Shifting (BEPS) was signed by Finance Minister Arun Jaitley here at a ceremony held at the OECD on Wednesday reaffirming India's commitment to cooperate in the global efforts to tackle aggressive tax planning," the Finance Ministry said in a statement.

Jaitley is on a four-day visit to Paris to participate in the OECD meetings.

Signatories representing 68 jurisdictions signed the convention which will have the effect of amending most of the bilateral tax treaties of the signatory jurisdictions in respect of treaty-related measures under the BEPS package for preventing artificial tax avoidance, prevention of treaty abuse, and improve dispute resolution.

"The event marks a milestone in the global efforts to check tax evasion and tax planning strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax jurisdictions where there is no or little economic activity resulting in no or little overall corporate tax being paid," the statement said.

The multilateral convention aims at the swift and consistent implementation of the treaty related BEPS measures.

The convention is an outcome of the OECD/G20 BEPS project. In view of this, the convention was conceived as a multilateral instrument which would swiftly modify all covered bilateral tax treaties to implement BEPS measures.

For this purpose, the formation of an ad-hoc group for the development of such multilateral instrument was endorsed by the G20 Finance Ministers and Central Bank Governors in February 2015.

"India has been a very active player in this global initiative and has significantly contributed to the development of the new international standards under the BEPS package. India would welcome more and more jurisdictions to become signatories the multilateral convention and also include more of their bilateral treaties as covered tax agreements," it said.

The convention will ensure that the minimum standards regarding prevention of treaty abuse and amelioration of the international tax dispute resolution process are implemented in all covered tax agreements quickly.

"Other BEPS outcomes such as amendment of the definition of the term 'Permanent Establishment' to plug unintended interpretation leading to fiscal evasion, prevention of double non-taxation of hybrid entities, time threshold for treaty benefits to dividend and capital gains transactions will be incorporated in the covered tax agreements where all contracting parties agree," it added.