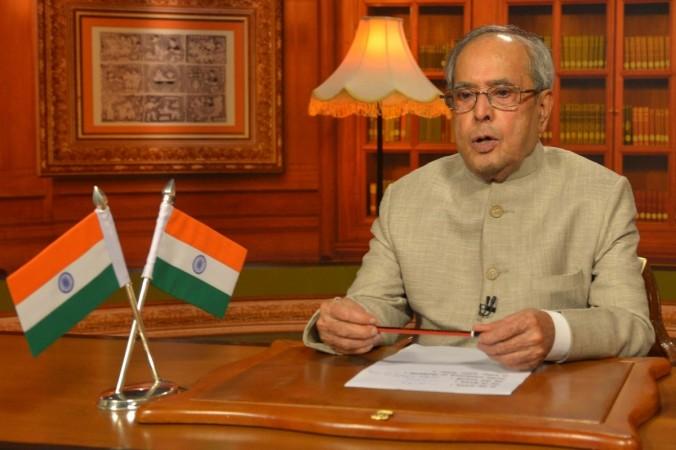

The Goods and Services Tax (GST) Bill became a law on Thursday after president Pranab Mukherjee approved it, paving the way for the eventual replacement of multiple indirect taxes with a unified tax structure across India.

Earlier, the GST Bill was ratified by sixteen states as a precondition to securing the president's assent. Assam was the first state to ratify the legislation. The Bill was unanimously passed by both Houses of the Parliament last month.

The Narendra Modi government has fixed April 1, 2017 as the deadline for implementation of the GST. On Wednesday, finance minister Arun Jaitley had spoken of the need for expediting the next steps to implement the GST.

A contentious part of the process of implementing the GST is the fixation of the standard rate. India Inc. as well as political parties have suggested different rates, making the task of the GST Council difficult.

The Congress insisted on capping the standard rate at 18 percent.

Many economists, analysts and policymakers have hailed the the GST as an important legislation. "The move to a GST regime will be beneficial for the economy on multiple counts, even though there are likely to be growth, inflation and fiscal implications," Radhika Rao, economist, group research, DBS Bank said in a note last month.