![[Representational Image] aadhar 11111111](https://data1.ibtimes.co.in/en/full/672669/aadhar-11111111.jpg?w=699&h=414&l=50&t=40)

The Department of Revenue in the Ministry of Finance in India on Tuesday, December 12 has said that the deadline to link the 12-digit aadhaar card number to any account related proceedings is March 31, 2018.

The announcement by the government comes ahead of the hearing on Thursday, December 14, by a Supreme Court bench of Justices Dipak Misra, A.M. Khanwilkar and D.Y. Chandrachud.

The SC bench will hear pleas from petitioners who have pressed for an extension of interim relief on the mandatory linking of Aadhaar to various schemes, including bank accounts and mobile numbers. IANS reported, "A bench headed by Chief Justice Dipak Misra on Wednesday said the matter will be heard at 2 pm on December 14."

Earlier on December 7, the government had informed the Supreme Court that the deadline could be set for March 31, 2018.

It has been decided by the Government to notify 31st March, 2018 or six months from the date of commencement of bank account based relationship by the client, whichever is later, as the date of submission of Aadhaar number& PAN or Form 60 by the clients to the reporting entity.

— Ministry of Finance (@FinMinIndia) December 13, 2017

The set deadline for March next year was withdrawn earlier on Tuesday following a Gazette Notification which read that "new timelines will be intimated later."

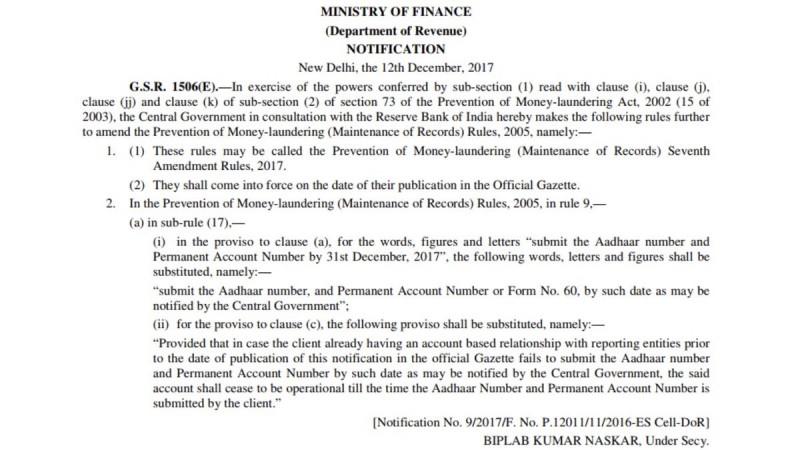

After the government confirmed the new deadline on Wednesday evening, the new norms in the Gazette modify the Prevention of Money Laundering Act (PMLA) of 2002 and read as: "Submit the Aadhaar number, and Permanent Account Number or Form No. 60, by such date as may be notified by the Central Government".

Aadhaar is issued by the Unique Identification Authority of India (UIDAI) and the Income Tax Department allots the PAN. Form 60 is a declaration filed by an individual or a person (not being a company or firm) who doesn't have a PAN and who tends to conduct any specified transaction.

The gazette also warned of existing accounts to be ceased if they are not linked to the Aadhar until the date which is yet to be announced as an official deadline for Aadhaar and accounts linkage.

An excerpt from the gazette read, "If the account holder fails to submit the Aadhaar number and PAN by such date as may be notified by the central government, the said account shall cease to be operational till the time the Aadhaar number and Permanent Account Number are submitted by the client."

Reason claimed over Aadhaar's extended deadline

The government ever since demonetisation has been trying to impose regulations under the PMLA. Certain regulations in the PMLA impose obligation on reporting entities like the financial institutions and banks.

These entities are then duly responsible to gather all the required proofs from an account holder or a transaction seeker and later submit all the data to the Financial Intelligence Unit of India (FIU-IND).

"Every reporting entity shall at the time of commencement of an account-based relationship identify its clients, verify their identity and obtain information on the purpose and intended nature of the business relationship," an excerpt from PMLA read in CNN-News18 report.

Meanwhile the PMLA caters to all the legal financial procedures including cash transactions from foreign countries and purchase and sale of immovable property valued over Rs 50 lakh or more also fall under this category.