Seeking hopes for survival amidst the coronavirus threat and global economic slowdown denting business profit margins, Finance Minister of India Nirmala Sitharaman made some key announcements to bring much-needed relief during these difficult times to individual taxpayers and businesses across the country - considering the deadline of submission of income tax files is nearing March 31.

Combatting Coronavirus: Tax relief initiatives announced

In a slew of initiatives announced by the Finance Minister, Nirmala Sitharaman, a key among them is the deadline extension provided for filing income tax and GST returns till June 30, 2020. The government has further issued a waiver on charges levied in case of cash withdrawals from ATMs of other banks, thus offering little relief to the already distressed economy battling the pandemic.

A waiver of penalty, GST and late fee, along with deferment of e-invoicing and new returns announced earlier will help businesses cope with the huge cash crunch and focus on resumption of business processes, once the nation achieves a state of normalcy soon.

Also a relaxation in interest rate is applicable on delayed income tax returns. It has been reduced from the current 12% to 9%. Companies with turnover of less than Rs 5 crore will not have to pay penalty or late fees for filing delayed IT returns. The Customs clearance department will operate round-the-clock (24/7) till June 30 as an essential service.

Companies have been encouraged to increase their CSR spendings. Such measures to help promote healthcare, bring preventative and sanitation measures, disaster management to fight out Covid-19 is recognised as "an eligible CSR activity", according to the Ministry of Corporate Affairs.

Also extended timeline for the payment of Vivad se Vishwas scheme till June 30 is a welcome measure for businesses trying to cope and stabilize in the current times. The deadline for filing IT returns for 2018-19 and that of the current year, linking PAN with Aadhar and GST returns for 2018-19 and 2020 has been extended from March 31 to June 30, 2020. Will this really help?

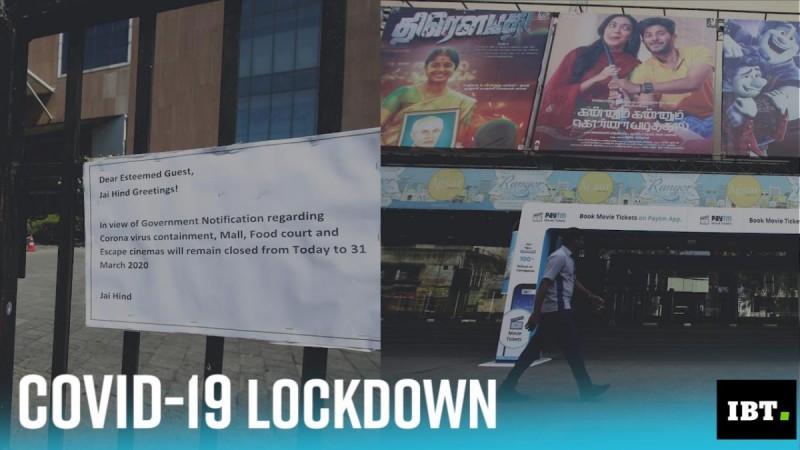

National-wide lockdown and economic impact

Nationwide lockdown mandated across cities, restricting people movement across states and impacting trade is causing huge economic disruption.

The loan default threshold on Insolvency and Bankruptcy Code (IBC) has been raised from the current Rs 1 lakh to Rs 1 crore now. Also waiver on minimum balance fee on the savings bank account and charge-free withdrawals from any bank ATM for the next three months is allowed.

For companies, the mandatory requirement of holding meetings of the board of directors has been relaxed by 60 days and a waiver on fees for late filings during the moratorium period is implied. Emphasising that these announcements were made to ease the burden of compliance on citizens during the lockdown period, Sitharaman indicated that an "economic relief package is in the works and will be announced sooner than later."

In the much anticipated package intended to provide economic stimulus, some of the initiatives underway are:

- The RBI and the government are in talks to raise borrowing for the next financial year. Higher borrowing will aid the economic stimulus plan.

- The central bank may be asked to directly buy government bonds.

- The fiscal deficit target will be widened by 100 basis points.

- Government is further mulling setting up of a market stabilisation fund that will be used to creep in government stakes in quality PSUs, much like SPV investing in equities.

Many other measures to ease the growing cash crunch situation are being discussed by the Finance ministry, the government and the RBI to manage the current deficit and revive the economy from recession. A final decision on the new economic revival package from the centre is expected soon.