Prime Minister Narendra Modi launched the "Transparent Taxation – Honoring the Honest" platform via video conferencing today, which is intended to further the journey of direct tax reforms in the country. The Faceless Assessment and Taxpayers Charter launched today by the Prime Minister will come into effect from September 25.

The launch event was witnessed by Union Minister of Finance and Corporate Affairs, Nirmala Sitharaman, Minister of State for Finance and Corporate Affairs, Shri Anurag Singh Thakur, members of Chambers of Commerce, Chartered Accountants' associations, Trade Associations, and officers and officials of Income Tax Department.

In the recent years, several major tax reforms in direct taxes have been carried out by the Central Board of Direct Taxes (CBDT) with abolishment of dividend distribution tax, reduction of corporate tax rates from 30 percent to 22 percent, and reduced to 15 percent for new manufacturing units.

"The focus of the tax reforms has been on reduction in tax rates and on simplification of direct tax laws. Several initiatives have been taken by the CBDT for bringing in efficiency and transparency in the functioning of the IT Department. This includes bringing more transparency in official communication through the newly introduced Document Identification Number (DIN) wherein every communication of the Department would carry a computer generated unique document identification number," the press release stated.

Similarly, to increase the ease of compliance for taxpayers, the IT Department has moved forward with pre filing of income tax returns to make compliance more convenient for individual taxpayers. Compliance norms for startups have also been simplified.

The IT department is committed to take the initiatives forward and has also made efforts to ease compliances for taxpayers during the Covid times by extending statutory timeliness for filing returns and also releasing refunds expeditiously to increase liquidity in the hands of taxpayers.

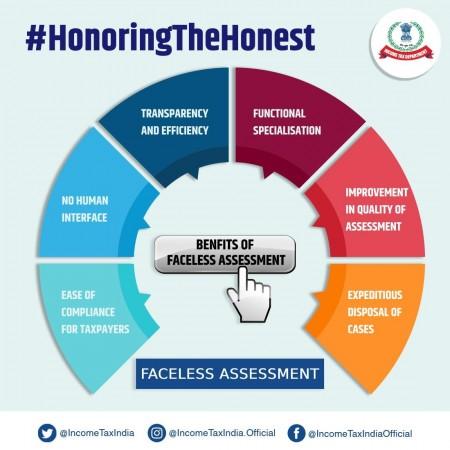

Introduction of reforms such as the faceless assessment, faceless appeal and taxpayers charter, the Transparent platform is intended to further strengthen the nation's taxation system.

What does the Faceless Assessment scheme mean?

This scheme is intended to eliminate the human interface between the taxpayer and the income tax department. "The government is now focussing on making tax-paying seamless, painless, faceless. Faceless as it shouldn't matter who is paying tax and who is tax officer. Taxpayers will now be given the respect they deserve. The taxpayer will now be trusted, not looked at with doubt. The tax department will have to carry out the steps and processes in a time-bound manner," PM Modi said.

"Over the past six years, the government has remained focused on banking the unbanked, securing the unsecured and funding the unfunded. In a way, today's launch marks a new beginning in this direction," the Prime Minister added. "Till now, all tax-related matters in a city are dealt with by the Income Tax department of that city. Now with the help of technology, scrutiny will be done by a randomly chosen IT officer anywhere in the country."

How will Faceless appeal work? Steps are as detailed below:

- The taxpayer will be selected by the system using data analytics and AI.

- The territorial jurisdiction of the taxpayer will be abolished, which means the taxpayer could belong to one city but the ITR may be assessed in some other city through random selection by the computer system.

- Random allocation of cases will be automated and central issuance of notices with Document Identification No.(DNI) will be notified.

- There will be no physical interface and no need for taxpayers to visit the Income Tax office. The appeals will be randomly allotted to any officer in the country and the identity of the officer deciding the appeal will remain unknown.

- There will be team based assessments and review, which means draft assessment order will be carried out in one city, the review in another city and finalisation of the income tax will be in the third city.

This means there will be faceless teams across India checking IT returns and addressing grievances. The Income Tax department will adopt a 'taxpayer charter' that will outline the rights and responsibilities of both the tax officers and taxpayers.

What is ‘Faceless Assessment & Faceless Appeal’ and how will you benefit?

— Anurag Thakur (@ianuragthakur) August 13, 2020

Find out here ??#HonoringTheHonest pic.twitter.com/K7fg2wyFjU

Faceless Assessment Scheme is government's way of #HonoringTheHonest. With dynamic jurisdiction and team-based assessment you can respond to the scrutiny notice online. There is no need for taxpayers to go to the IT office or meet a local IT officer. Speedy completion of cases is another hallmark of the scheme.

CBDT, u/s 119 of the IT Act has directed officers in Directorates of Investigation (Investigation Wing) & Commissionerates of TDS, only and exclusively shall act as (Income Tax Authority) for the purposes of power of survey u/s 133A of I-T Act.

Hereafter, under section 119 of the IT Act has directed that all assessment orders should be passed by the National e-Assessment Centre through the Faceless Assessment Scheme 2019. There will be no intrusion or interference of field officers, only the investigation wing and TDS wing can look into the case after approval from officers of the level of Chief Commissioner.

What are the Exceptions or Exclusions to the scheme?

Urging taxpayers to pay taxes on time as their responsibility towards the government and society, PM Modi detailed exclusions to the Faceless Assessment scheme - these include international taxation, major tax evasion, serious frauds and Black Money Act & Benami Property.

Any communication from the Income Tax Department without a computer-generated DIN, be it a notice, letter, order or summon or any other correspondence, will be invalid and shall be non-est in the eyes of law. #HonoringTheHonest pic.twitter.com/UXJ5kkbR0h

— NSitharamanOffice (@nsitharamanoffc) August 13, 2020

Finance Minister, Nirmala Sitharaman tweeted, "Any communication from the Income Tax Department without a computer-generated DIN, be it a notice, letter, order or summon or any other correspondence, will be invalid and shall be non-est in the eyes of law."

Amidst all these efforts, the number of people filing income tax returns has increased by about two and a half crores in the last 6-7 years. But it is also true that in a country of 130 crores it is still very less.