Taking serious note of fraudulent claims of Income Tax refunds by some employees of various departments, authorities of the Union Territory of Jammu and Kashmir on Monday directed all the Heads of Department (HoD) to take action against the erring employees.

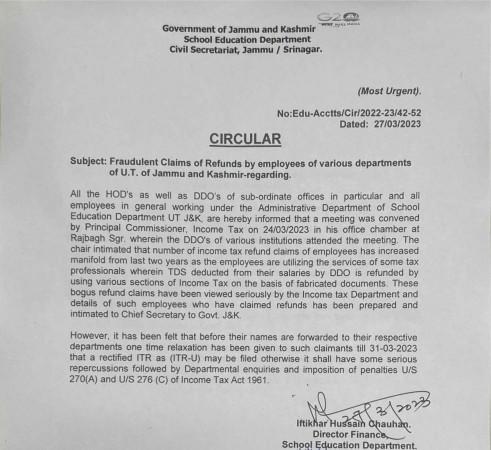

The School Education Department of the Jammu and Kashmir Government on Monday issued a circular No:Edu-Acctts/Cir/2022-23/42-52 Dated: 27/03/2023 as Most Urgent in which directions were issued to all HoDs.

"All the Heads of Department (HoDs) as well as DDO's of sub-ordinate offices in particular and all employees, in general, working under the Administrative Department of School Education Department UT J&K, are hereby informed that a meeting was convened by Principal Commissioner, Income Tax on 24/03/2023 in his office chamber at Rajbagh Sgr. wherein the DDOs of various institutions attended the meeting", the circular reads.

Employees claiming refunds through fabricated documents

In the meeting, it was intimated that the number of income tax refund claims of employees has increased manifold in the last two years as the employees are utilizing the services of some tax professionals wherein TDS deducted from their salaries by ODO is refunded by using various sections of Income Tax on the basis of fabricated documents.

These bogus refund claims have been viewed seriously by the Income-tax Department and details of such employees who have claimed refunds have been prepared and intimated to the Chief Secretary of Jammu and Kashmir.

However, it has been felt that before their names are forwarded to their respective departments time relaxation has been given to such claimants till 31-03-2023 that a rectified lTR as (ITR-U) may be filed otherwise it shall have some serious repercussions followed by Departmental inquiries and imposition of penalties U/S 270(A) and U/S 276 (C) of Income Tax Act 1961.

Income Tax Department prepares a list of such employees

Reports said that the Income Tax Department has complete details of all such erring employees, who belong to Education, Health, PDD, PHE, Cooperatives, Sports, Tourism, Industry, PWD, Police, and other departments of J&K Government.

Such cases of bogus refunds may lead to scrutiny and recoveries of demand besides the levy of penalty under Section 270A of the Income Tax Act, which is 200 percent of the tax levied. Further, the case of such employees may also be taken up for prosecution under Section 276C of the IT Act.

The matter came to light during the analysis of the refunds issued in the Financial Year 2021-22 and 2022-23 in respect of Income Tax Returns filed by the taxpayers of Jammu and Kashmir for Assessment Years 2020-21, 2021-22, and 2022-23.

The analysis of data revealed that a large number of individual taxpayers, particularly those who derive income from salaries, have claimed excessive deductions under various Sections of the Income Tax Act viz. 80C, 80D, 80DD, 80DDB, 80EB, 80E, 80EE, 80G, 80GGC etc without actually being eligible for such deductions. This way they have claimed the refunds of Tax Deducted at Source (TDS) made by their DDOs, either substantially or fully.