The Indian market is one of the fastest-growing smartphone markets around the world. Indian consumers focus mostly on the specifications and that is why manufacturers are competing neck-to-neck by rolling out smartphones at attractive prices.

In the wake of tectonic shifts in the mobile space, we are listing out the top five smartphone vendors in India based on their year-on-year (YoY) growth for the calendar year (CY) 2019. The data has been taken from Counterpoint Research, Canalys, and CMR market share reports.

Xiaomi leads the pack

Xiaomi continues to enjoy the top position in the Indian smartphone market. According to the Counterpoint market research data, Xiaomi with 28 percent market share registered 5 per cent YoY growth for CY2019.

The Canalys report shows that the Xiaomi holds a 29 percent market share with an annual YoY growth of 5 per cent for CY2019. CMR's India Mobile Handset Market Review Report for Q4 2019 also claims that Xiaomi with 29 percent market share is still the smartphone market leader in India with a YoY growth of 5 percent.

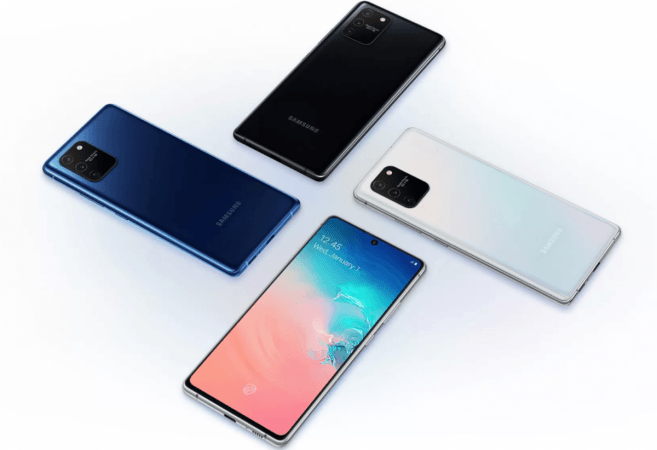

Samsung's market share plunges

The number two smartphone vendor, according to Counterpoint Research, is Samsung that holds 21 percent market share in the country. However, Samsung actually saw a decline of 5 percent in CY2019. Similar trends have been showcased by Canalys and CMR reports.

As per Canalys, Samsung's market share is 22 percent after it declined by 9 percent in CY 2019. As per CMR, Samsung holds 23 percent market share after its smartphone market share declined by 2 percent in CY2019.

Vivo registered impressive growth

Counterpoint data claims that Vivo's market share saw 76 percent YoY growth in CY 2019 to grab 16 percent in India. The Canalys report claims Vivo saw 72 percent growth to reach 17 percent market share in 2019 whereas CMR claims the company holds 16 percent market share after an impressive YoY growth of 84 percent in CY2019. CMR says that Vivo's growth was particularly driven by the sales of its S and Y series smartphones.

Realme, Oppo follow lead

As per Counterpoint Research data, Realme grew by 255 percent in 2019 to grab 10 per cent market share in the country - a figure that puts Realme on the fourth position ahead of Oppo. The Canalys report says that Realme grew by 473 percent in CY2019 to grab 11 per cent market share whereas CMR report says that Realme saw YoY growth of 246 percent in CY2019 to reach 10 percent market share in the country.

According to Counterpoint, Oppo holds 9 percent market share after a YoY increase of 28 percent in CY2019 whereas Canalys claims that Oppo holds 11 percent market share after it witnessed a 44 percent YoY growth in CY2019. According to CMR, OPPO registered 17 percent YoY growth in CY2019 to reach 8 percent market share mark on the back of its successful A series.

In the race between Xiaomi, Samsung, Vivo, Oppo and Realme, Apple also managed to registered a YoY growth of 17 per cent in CY2019, according to CMR report.