The Budget of any nation is one way in which the government can instantly and directly improve the economic status and quality of life of its citizens. If it wants to, that is. With several expectations and speculations already under way on social media and corporate circles; finally on Thursday, February 1, Finance Minister Nirmala Sitharaman presented the Union Budget 2024 in the Lok Sabha. Being an interim budget as it comes ahead of the Lok Sabha elections, no changes have been introduced in the tax slabs in both old and new regimes.

"Over the last ten years, the direct tax collections have more than trebled and the return filers swelled to 2.4 times," said Sitharaman while presenting her sixth budget in a row. She also said that the government proposes to maintain the same tax rates for direct and indirect taxes, including import duties.

What is an interim budget?

While the full budget will be tabled in July this year after the new government takes charge post Lok Sabha polls, the interim budget meanwhile can be accessed through the Union Budget mobile app. As the name clearly suggests, the Interim Budget is presented for an interim period of time and therefore focuses on maintaining continuity of schemes rather than major policy shifts.

Every Budget. #Budget2024 pic.twitter.com/AH0zjFGIwZ

— Narundar (@NarundarM) February 1, 2024

Budget or election speech?

Among the key changes includes tax benefits for startups and investments made by sovereign wealth or pension funds. The tax exemption on income from IFSC units, earlier expiring on 31st March this year, will now continue till 31st March 2025. But before tabling the budget, Nirmala Sitharaman thanked the PM and trumpeted the Indian economy, making several on the opposition benches later question if she was campaigning for the government.

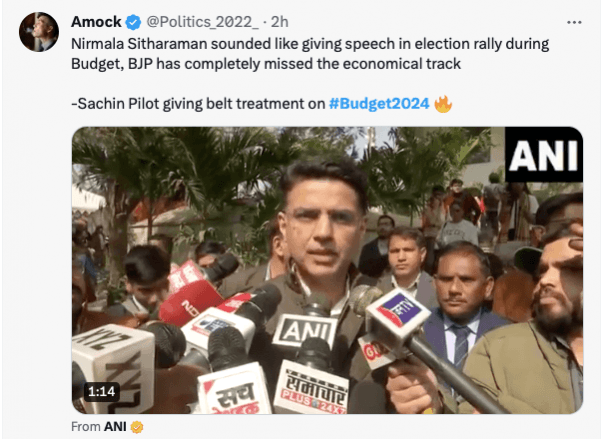

"Nirmala Sitharamn sounded like giving speech in an election rally," said Congress leader Sachin Pilot later to reporters. However, even for those politically neutral, each year the budget provides content creators with fertile ground for spreading awareness about inflation, economy and the fact that very little changes for the common man.

More people paying more taxes

Moving on, the tax receipts for FY 25 are pegged to 26.02 lakh crores. The fact, as pointed out by the FM, that tax reforms have widened the tax base and increased tax collections for the government, did not go unnoticed among those looking at the satirical situation. Each year, the direct and indirect taxes are the bane of the Indian middle class. Majority of which draw fixed salaries and can neither evade or avoid taxes.

To 'Fixed Salary Wale Log'.... #Budget2024pic.twitter.com/2AJ6mqUyFd

— Mohammed Zubair (@zoo_bear) February 1, 2024

What? Maldives?

Considering that political hue and cry over the diplomatic row with Maldives is yet to die down on social media, many netizens were left shocked when the Budget 2024 granted a Rs 770 crore loan to Maldives. This makes Maldives the second leading recipient of Indian government grants and loans to foreign governments for 2024-25. Bhutan being the first in the category with a grant of Rs 2398.97 crore. Several satirical posts highlighted the fact that while Indian government, its staunch loyalists and several Bollywood actors had made boycott calls on Maldives, here the government of India was allocating a princely sum of Rs 770 crore to the island nation.

Every single person who cancelled their trip to #Maldives this gif is for you all from #Modi Ji #Budget2024 #Budget pic.twitter.com/SkK2Npb36C

— RJ_tweets (@rohiit_jain) February 1, 2024

Memes, infrastructure and Nitin Gadkari

The Finance minister also said in her budget speech that the allocation for capital expenditure for the financial year starting April 1 is 11.1 percent higher than the capex for the current financial year. Which means Indian government will spend ₹11.11 trillion on infrastructure creation in 2024/2025. The announcement led many to compare Nirmala Sitharaman Covid stimulus package where she announced Rs 20 lakh crore. Many immediately circulated The Telegraph Headline where the 2 is followed by 13 zeroes. "Rs 20000000000000...by the time you finish counting the zeroes, hopefully Ms Sitharaman will share the details."

Others pointed out the earlier rift speculations between Minister for Road Transport and Highways Minister Nitin Gadkari and PM Narendra Modi.

Nitin Gadkari after knowing infrastructure budget to be 11,11,111cr for the Next year

— Aj (@AjessePinkman) February 1, 2024

#Budget2024 pic.twitter.com/5SS05NvjBo

For many, in disagreement with the current government and its policies, it is the time to compare the Indian economy as under former Prime Minister Dr Manmohan Singh and under the current Prime Minister. Apart from no changes in direct or indirect taxes, the Fiscal Deficit target for FY25 is 5.1% of GDP. However, for its fiscal deficit target figure of 5.1%, the government has assumed nominal GDP growth of 10.5% in the financial year. Once again, a netizen was quick to remark, "Union budget is like terms and conditions of an app. I do not read them, let alone understand them. But I don't have an option but to comply completely." While the good or bad can be debated upon, but that sums it up for everyone involved, invested or affected by the budget.