Budget 2017 is already under printing, with the process commencing with the ceremonial halwa churning on January 19, 2017. The pre-budget wish-list submission therefore is long over, but analysts and economists continue to guess as to what could be in store for the people. Meanwhile, the Supreme Court gave the go-ahead on Monday for the presentation of February 1.

Read: Cash-ban distress leaves scant room for India budget giveaways

In its latest issue, SBI Ecowrap has shed light on what all one can expect from the Modi government in the forthcoming budget, which comes amid a plea in the Supreme Court seeking its postponement till assembly elections are over. The case will be heard on Monday (January 23).

The Modi government's fourth budget needs to be seen in the background of demonetisation that has slowed down the world's fastest-growing economy and therefore needs a stimulus, Soumya Kanti Ghosh Group Chief Economic Adviser, State Bank of India and author of the report, said.

Four likely incentives for individual tax payers

a. Minimum personal income tax exemption limit

"We expect an increase in personal income tax exemption limit from Rs 2.5 lakh to Rs 3.0 lakh," Ghosh wrote. There have been calls earlier to raise the limit to as high as Rs 5 lakh to increase the disposable income in the hands of people and thereby spur consumer spend.

b. Deductions under section 80C of the Income Tax Act

Ghosh said that Finance Minister Arun Jaitley is likely to enhance the amount qualifying for deduction under the section from the current Rs 1.5 lakh per annum to Rs 2 lakh.

c. Interest on home loans

In addition to the sops announced by PM Narendra Modi on December 31, 2016, the government is likely to raise the interest exemption on housing loan from Rs 2 lakh to Rs 3 lakh.

d. Unlock the lock-in clause for bank deposits

Ghosh said that the government may either reduce the lock-in period (if not abolish) for bank fixed deposits from the current five years to three years for availing tax exemption. Interest income up to Rs 10,000 annually is current exempt.

Cost of incentives for individuals

The impact of these expected changes? "Such giveaways will cost Rs 35,300 crore but we expect this to be more than balanced by IDS2 revenue and cancelled note liabilities of RBI," Ghosh said. The reference is to the second amnesty scheme (PMGKY 2016) and the fiscal dividend on account of banned notes unlikely to be returned to the banking system.

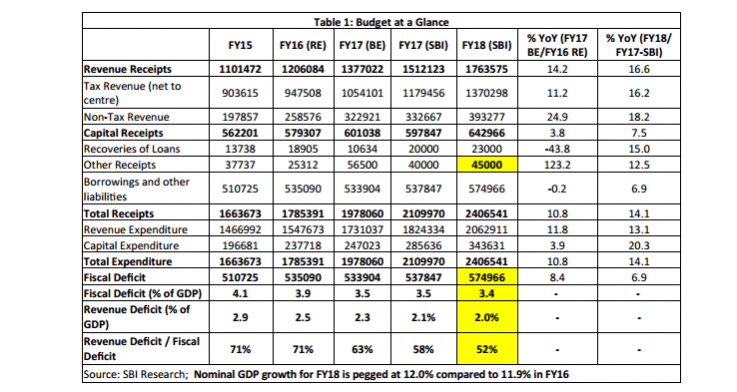

The SBI Ecowrap also said that the Modi government is likely to borrow Rs 4.05 lakh crore in FY2018 on a net basis after adjusting for redemptions of Rs 1.75 lakh crore.

The fiscal deficit for the forthcoming financial year (2017-18) is expected to be fixed at 3.4 percent of GDP (Rs 5.75 lakh crore).

Here is a snapshot of the government's likely revenues and expenses at a glance:

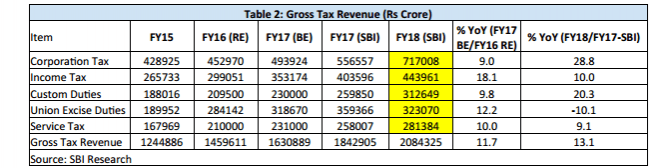

The tax collection projections for FY2017: