Blockchain has increasingly been receiving much attention from corporates around the world with a greater realization of the benefits that they can leverage around it. No more is the term restricted to the developer community but finding widespread acceptance among the industry. Global spending on blockchain solutions has a forecasted CAGR of 76%, reaching USD 12.4bn by 2022.

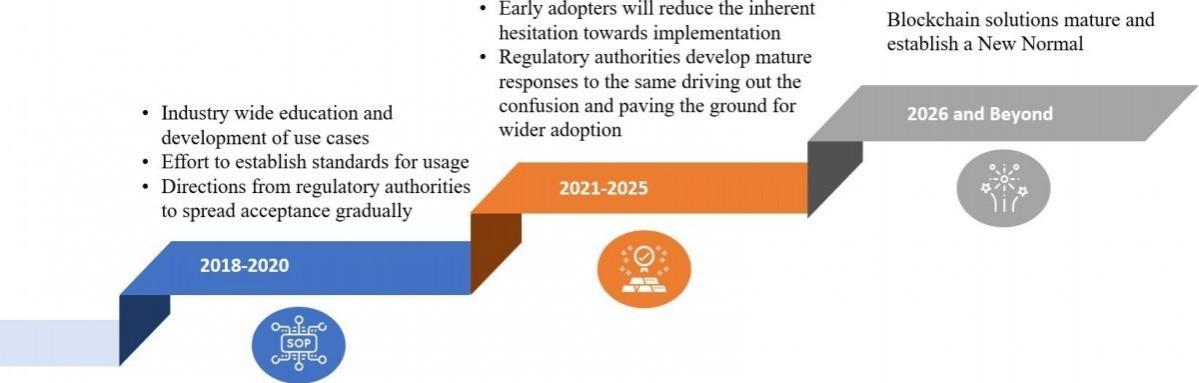

Blockchain in Transport Alliance (BiTA) lays down a suggestive timeline for blockchain as below :

There is a long way to go for blockchain initiatives. According to a recent Accenture survey, currently, 64% of blockchain initiatives are funded by IT/research and innovation budgets, indicating greater thrust on technology than on organizational fitment. Only 38% of the respondent firms had a clear business case before investing. Innovation, rather than business case, remains the primary driving force behind blockchain implementations, threatening their organisational acceptance.

The what and why of Blockchain

Blockchain is emerging as the new technology paradigm in the supply chain areas – Blockchain, along with IoT, forms one of the crucial pillars for Industry 4.0.

Blockchain, in the most basic essence, is a distributed ledger technology (DLT) – in simpler terms, much like traditional accounting ledgers with few important exceptions:

It is shared across all members on the blockchain and hence against traditional ledgers, where the flow of information is successive, here all members are capable of seeing the changes in real-time.

It is immutable – blockchain records need the consensus for becoming a part of the chain, something that is not easy to generate.

Blockchain systems are more secure due to layers of cryptographic security parameters. They are also permissioned to the extent desired to regulate the access to stored information among the members.

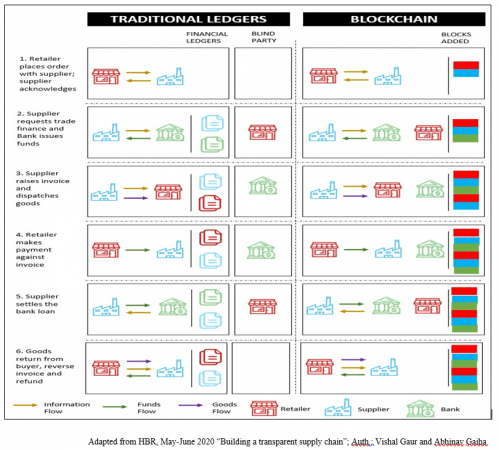

The natural question that then arises is why supply chain and blockchain are touted together so much. The answer lies in the inherent transactional complexity of the supply chains. Traditional supply chains are long and extend across multiple players. A few characteristics of supply chains that make blockchain highly relevant are flows that may never be recorded in accounting books (like order placement) that nevertheless hold importance, presence of parties that need information but may never be privy to the originating transaction (like insurers and banks) and high volume of documentation, which complicates the supply chains.

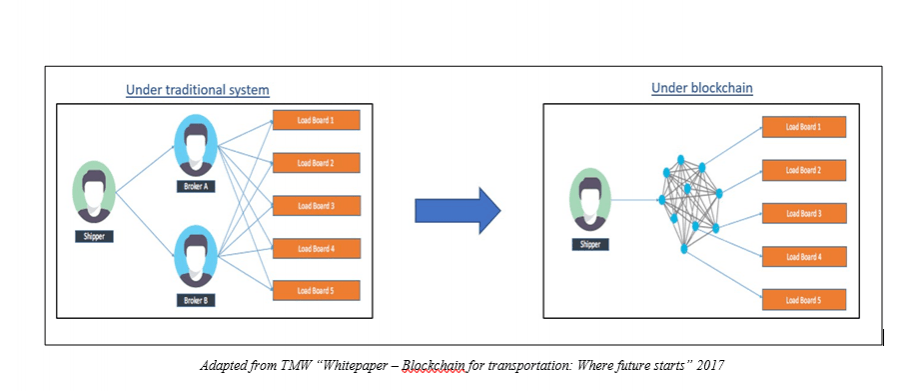

The below graphic helps in understanding the case in point:

Key motivations behind Blockchain

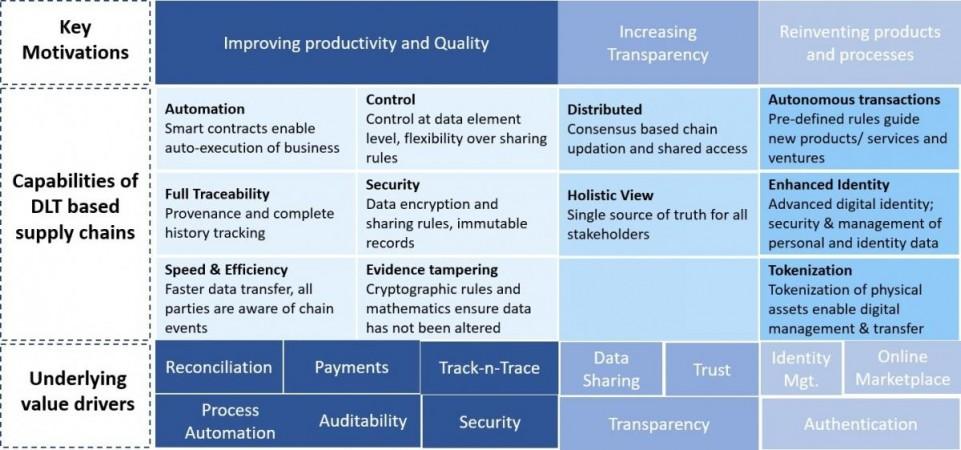

The emerging use cases around blockchain offer valuable insights about the major motivations behind the new initiatives in the sector by important players. The below graphic, adapted from Accenture's "Get the full picture- assessing blockchain business value", shows the major capabilities that are offered by DLT based supply chains:

We now discuss some of the use cases where blockchain has been employed across the supply chain. It is important to appreciate that blockchain solutions are still in the experimental phase, where players are still trying to discover value propositions, and hence, per se, it is extremely difficult to find 'over the counter' products based on it. Use cases in this area are still evolving and being modified to suit the organizational purpose.

Automating Proof of Delivery (PoD) and payments through Smart Contracts

OpenPort, ShipChain

A blockchain-based company, ShipChain, enables electronic recording of PoD and further allows payments to providers in a digital currency called "SHIP Tokens". Digital currencies are increasingly being used across DLT based supply chains and modern TMS's will have to adapt to them. As per a TMW report, the payment cycle can range from 7 to 21 days for a freight company. With blockchain, this period can be substantially reduced.

Digitization of L/C's

Voltron based on R3's Corda

Contour (formally, Voltron) is a platform based on R3's Corda blockchain network and sponsored by 8 global banks like HSBC, Nat West, and Standard Chartered, which seeks to digitize the LC issuance process to substantially reduce the processing time from 5-10 days to 24 hours. In a blockchain environment, L/C's can be negotiated as a smart contract between importer, exporter, and their respective banks. Also, trade documents can be linked with physical goods through crypto-tokens to remove reliance on physical copies. While the process for a blockchain L/C is essentially the same as traditional physical systems, the time spent in processing is substantially reduced due to information sharing, auto-executed smart LC contracts and elimination of paper trails.

Digital Bill of Lading

ZIM + Wave, Portall - CargoX BDT (Blockchain Document Transfer)

An interesting development in this context is India's recent initiative to digitize the port processes. With COVID lockdown in force, it was impossible for the traders and carriers to physically exchange trade documents. CargoX partnered with Indian Port Community System designer Portall to allow the carriers to issue digital B/L's which can then be exchanged on PCS with importers. A similar e-B/L has also been developed by Israeli carrier ZIM, in collaboration with Wave. It is noteworthy that BDT potential exists for all supply chain documentation, however, the success of the same depends on the readiness of the merchants and acceptance of the same by regulatory authorities.

Carrier Onboarding

With blockchain, the process of carrier onboarding can not only be simplified but also undertaken in a collaborative environment to save resources. Information pertaining to carriers can be stored in an immutable fraud and forgery-proof form on a commonly shared blockchain. Further verification services can be performed by dedicated parties and shared with all – such parties can be incentivized for their work in digital currency.

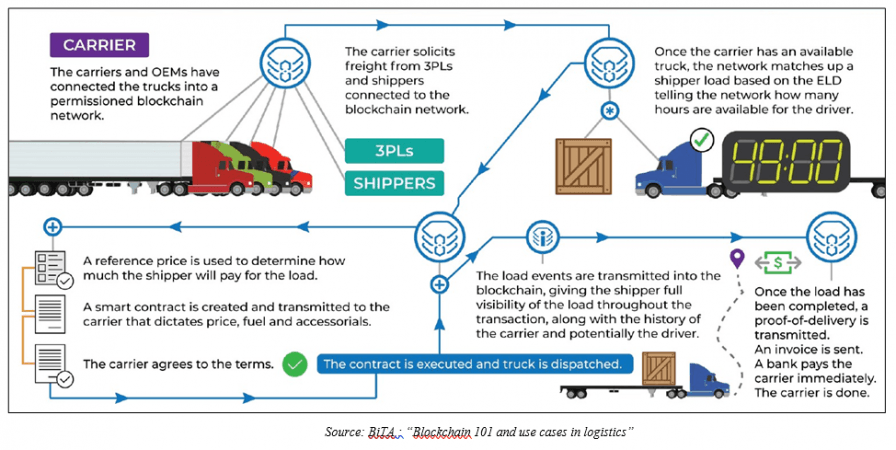

Trusted load boards - integrated logistics network with 3PL's

With blockchain, the data pertaining to loads can be centralized and shared with multiple parties to have a single source of truth. This not only helps the carrier to plan their capacities better but also provides brokers with real-time updated information to book their requests and evades problems like double booking, unavailable capacity, and incorrect demand planning.

Another benefit that can be derived from such centralized trusted load boards is to have an online logistics marketplace where the sender and the transporter can share information on a common platform. Supported by smart contracts and pre-fed master data such as freight rates, demand for loads can be transmitted based on dispatch data of the sender's ERP – system then matches this demand with available capacity and the contract is executed on reference freight rates once parties agree to terms.

Payment instrument digitization

In typical supply chain scenarios, raising trade finance presents multiple problems like verification of trade documents, disparate information about goods movement, and high auditability issues. Risk of frauds like duplicate financing, forged invoices, etc. forces banks to adopt stringent audit requirements before granting the finance which lengthens the procedural requirements.

The emerging area now being explored under the blockchain paradigm is to issue payment documents native to the blockchain. In simpler words, on fulfilment of orders, invoices/bills of exchange indicating the payment liability are issued on the blockchain itself signifying a contract between the parties. This counters fraudulent invoicing practices to a great extent and allows SME's with greater access to capital.

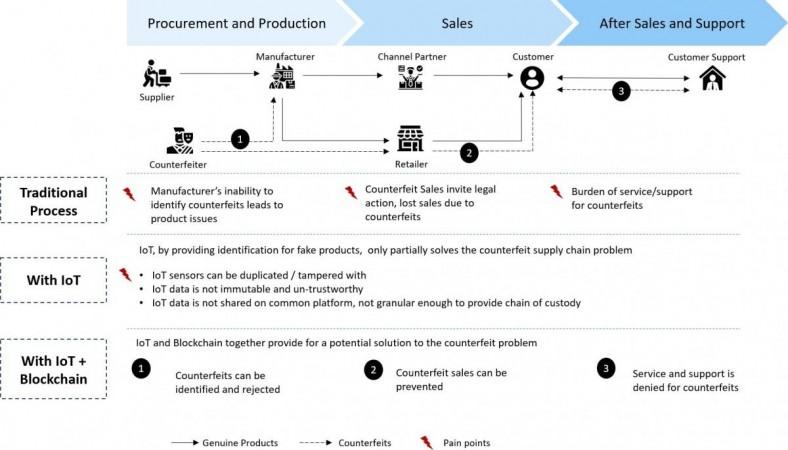

Tackle counterfeiting

Everledger, DHL + Accenture Pharmaceutical Serialization

Counterfeiting is rampant across sectors like medicines, electronic components, and even Nike's Air Jordans. Though Blockchain or IoT, on their own, cannot deal with this problem, use cases are now emerging, which utilize these two technologies, in tandem, to weed out counterfeits from supply chains. Where IoT allows for continuous signature tracking of products, blockchain makes IoT data immutable and shareable. Smart tags, that are hard to replicate and uniquely identify a product, are affixed to the products and then tracked as they move across the chain – any tampering of goods can be easily identified.

Everledger is a blockchain-based company that deals with providing provenance for luxury and expensive products like wine, art, and diamonds. To illustrate, Everledger creates a digital token of every diamond, comprising of more than 40 data points unique to a diamond, besides clarity, cut, and carat which are recorded on a blockchain network and shared across all partners. This not only allows for a solution against counterfeiting or forged authenticity certificates, but the same can then also be used to provide proof of origin against 'blood diamonds'.

Tracking provenance in supply chains

Starbucks; Provenance; IBM Food Trust; Welspun 'Wel-trak', IBM-Maersk Trade Lens

With a wave of consumerism spreading across the world and consumers being more conscious about what they consume and from where it comes, retail players all over the world are striving to provide their customers with proof of provenance. With DLT, goods can always be tracked, right from their point of origin until they find their place in customer's homes. Starbucks's 'Bean to Cup' initiative, based on Microsoft Azure, tries to give customers a glimpse of the journey the coffee beans have covered from the farm to their cup. Tracking data is consistently written on the platforms as it changes hands so that customers, just by scanning a QR code, know everything about the origins of their product.

IoT to track transport conditions

Walmart; SAP – Modum - Swiss Post; ShipChain - GTX

Transport conditions like temperature, humidity, tilt, etc. have a huge impact on the quality of goods. IoT sensors embedded in the products help companies to monitor these conditions to ensure freshness and quality of products. Recently, SAP helped Modum build a device called ModSense which helps track the temperature of medicines during their handling by Swiss Post. Blockchain tracking services provider ShipChain also recently partnered with GTX Corp to provide NFC enabled temperature sensing devices for temperature-sensitive shipments that write temperature readings at user-defined intervals on the blockchain network.

Besides the above use cases, there are also other emerging use cases in transportation industry, such as vehicle and driver performance tracking via constant vision over vehicle metrics and prevention against impostor carriers via a database holding the identities of the drivers which is beyond reproach and centrally available to all for verification.

Challenges in Blockchain

There are key challenges associated with blockchain, that make the businesses hesitant towards its adoption. Blockchain requires high computing power and is thus difficult to scale. Public blockchains can handle up to 20 transactions per second; Visa or Mastercard receive requests for more than 50,000 transactions per second.

Though processing capability improves for private blockchains through simpler consensus mechanisms, latency issues still prevent its widespread adoption. Further, successful blockchain use cases require collaboration with external parties who may have varying levels of digital readiness and desire for adoption. With the economic value of blockchain not yet concretely proven, getting the partners ready for a pilot may be difficult. Even inside the organisation, greater is the disruption, more is the effort required in the implementation, and no one can argue the largesse of blockchain led disruptions.

Moreover, there is a lack of standardization w.r.t storage and sharing of information on blockchain which also restricts inter-operability. Some of the industry initiatives like BiTA, which is a consortium of leading logistics service providers like FedEx, DHL, UPS, etc., are trying to overcome this challenge by proposing industry standards. This standardization also needs greater support from regulatory authorities. RBI has also released a paper, encouraging banking players to include blockchain in processes, and Indian banks can be seen to indulge in a lot of blockchain-centred initiatives to further improve payments, especially in areas of international and trade finance.

There are also privacy concerns surrounding the issue. Blockchain will imply sharing information among a network of players and organizations are justified to have concerns. Information on the blockchain network has to be carefully administered to monitor access and modification rights through encryption, enforcement of private key authentication, and cryptography.

It would be interesting to note further development as they arise in this sector and how the corporates respond to opportunities that emerge therefrom.

[Disclaimer: The author of this article, Ishita Gupta is an IIM Ahmedabad student currently pursuing PGP in Management.]