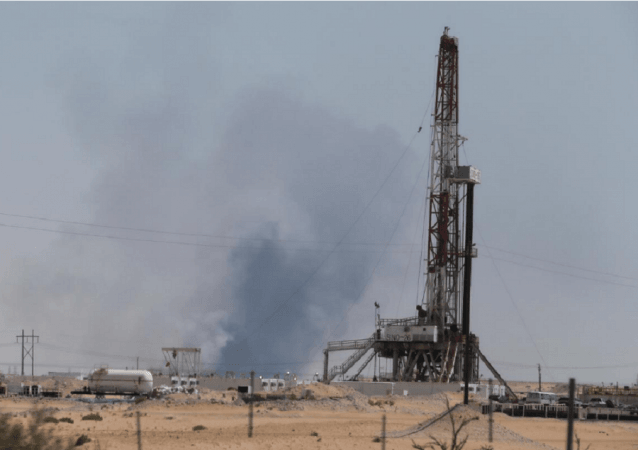

An attack on Saudi Arabia that shut 5 per cent of global crude output caused the biggest surge in oil prices since 1991, after US officials blamed Iran and US President Donald Trump said Washington was "locked and loaded" to retaliate.

The Iran-aligned Houthi movement that controls Yemen's capital claimed responsibility for the attack, which damaged the world's biggest crude oil processing plant. Iran denied blame and said it was ready for "full-fledged war".

Two sources briefed on the operations of state oil company Saudi Aramco told Reuters it may take months for Saudi oil production to return to normal. Earlier estimates had suggested it could take weeks.

Oil prices surged by as much as 19 per cent before coming off peaks. The intraday jump was the biggest since the 1991 Iraqi invasion of Kuwait that prompted the Gulf War.

Prices eased after Trump announced that he would release US emergency supplies, and producers around the globe said there were enough stocks stored up to make up for the shortfall.

"There is reason to believe that we know the culprit, are locked and loaded depending on verification, but are waiting to hear from the Kingdom as to who they believe was the cause of this attack, and under what terms we would proceed!" Trump said on Twitter on Sunday.

While Iran has denied blame for the attacks, its Yemeni allies have promised more strikes to come. Houthi military spokesman Yahya Sarea said the group carried out Saturday's pre-dawn attack with drones, including some powered by jet engines.

"We assure the Saudi regime that our long arm can reach any place we choose and at the time of our choosing," Sarea tweeted. "We warn companies and foreigners against being near the plants that we struck because they are still in our sights and could be hit at any moment."

US officials say they believe that the attacks came from the opposite direction, possibly from Iran itself rather than Yemen, and may have involved cruise missiles. Wherever the attacks were launched, however, they believe Iran is to blame.

"There's no doubt that Iran is responsible for this. No matter how you slice it, there's no escaping it. There's no other candidate," a US official said on Sunday on condition of anonymity.

Saudi Arabia and Iran have been enemies for decades and are fighting a number of proxy wars, including in Yemen where Saudi forces have been fighting against the Houthis for four years.

Overall tension in the oil-producing Gulf region has dramatically escalated this year after Trump imposed severe US sanctions on Iran aimed at halting its oil exports altogether.

THREATS

For months Iranian officials have issued veiled threats, saying that if Iran is blocked from exporting oil, other countries will not be able to do so either. However, Tehran has denied any role in specific attacks, including bombings of tankers in the Gulf and previous strikes claimed by the Houthis.

Foreign Ministry spokesman Abbas Mousavi called the US accusations of Iranian involvement in Saturday's attacks "unacceptable and entirely baseless".

China's foreign ministry said on Monday it was irresponsible to assign blame for the attack without conclusive facts. The British foreign secretary said a clearer picture was needed before discussing responsibility for a "wanton violation of international law".

The plant that was struck cleans crude oil of impurities, a necessary step before it can be exported and fed into refineries. The attack cut Saudi output by 5.7 million barrels a day, or around half.

Saudi Arabia is not only the world's biggest oil exporter, it has a unique role in the market as the only country that can increase or decrease its output by millions of barrels per day to keep the market stable.

A long outage would make markets subject to wild swings that could potentially destabilize the global economy. But big countries such as the United States and China have reserves designed to handle even a major outage over the short term.

Russia and an OPEC source said on Monday there was no need for an extraordinary meeting of the Organisation of the Petroleum Exporting Countries (OPEC) and its allies, a group known as OPEC+ that has orchestrated a supply-curbing deal.

Russian Energy Minister Alexander Novak told reporters there was enough oil in commercial stockpiles to cover the shortfall.

Aramco, which is gearing up for what could be the word's biggest IPO, has not given a timeline for resumption of supplies. Riyadh said it would compensate by drawing on stocks, which stood at 188 million barrels in June.

The US official who asked not to be identified said on Sunday there were 19 points of impact in the attack and evidence showed the launch area was west-northwest of the targets - not south from Yemen. Saudi officials had seen signs that cruise missiles were used in the attack, the official added.