With UPI, Paytm, and other forms of digital transactions, most of us still prefer visiting banks physically to update our passbooks, check ATM cards, and handle various other tasks. However, digital banking has transformed the way we access services, putting banking literally at our fingertips. Yet, talking to bank managers and asking questions that concern us will never go out of style. Physical branch visits are still essential for document corrections, KYC updates, account freezes, mandate failures, cheque-related matters, and loan servicing queries.

Although most private banks operate late and across six days a week, bank staff are now pushing for a five-day workweek. They have been voicing this demand for years, and it has resurfaced once again. Major banks such as ICICI, Axis Bank, Kotak, Yes Bank, and others, which employ Customer Relationship Managers available almost the entire day to assist premium clients, are also seeking fixed duty hours and a five-day working schedule.

This comparison aligns with the Indian IT sector, where a five-day work culture has been the norm for years. Bank employees argue that if many large conglomerates operate Monday to Friday.

Banks remain open on Saturdays primarily to accommodate working professionals, who cannot conduct banking activities during regular weekdays. To address this, some banks operate on the second and fourth Saturdays, offering the working population a crucial window to resolve issues without disrupting work commitments.

As of now, the Reserve Bank of India (RBI) has not issued any nationwide directive mandating a change in bank working days or branch timings. Existing RBI regulations provide banks operational flexibility to determine branch hours, cash counter timings, and service windows, provided customer service obligations are met.

Banks wanting a five-day work week justified?

Customer footfall for routine transactions has fallen sharply with the rise of UPI, mobile banking, and net banking. At the same time, regulatory compliance, audits, reporting obligations, and risk management workloads have expanded significantly. Backend efficiency now matters more than counter volumes. While bank employees may have free time during the week, Saturdays see a surge in customer visits.

Digital banking efficiently handles payments, balances, and transfers, but it cannot resolve exceptions. When problems occur, customers are still directed to visit branches. A five-day week would give employees Saturdays and Sundays off while allowing them to manage queries effectively during weekdays.

Banks also highlight that most services are available 24×7 through digital platforms. However, apps can freeze, require OTPs or passwords, and sometimes fail to process transactions, necessitating a physical visit. Bank employees deserve this improved work-life balance.

What's the current sitution now?

Gradually, banks have been shortening counter hours and expanding backend and digital operations without a formal change in working days. Any official change in branch hours or working days would require notification by individual banks and clear communication to customers. No such nationwide change has been announced so far.

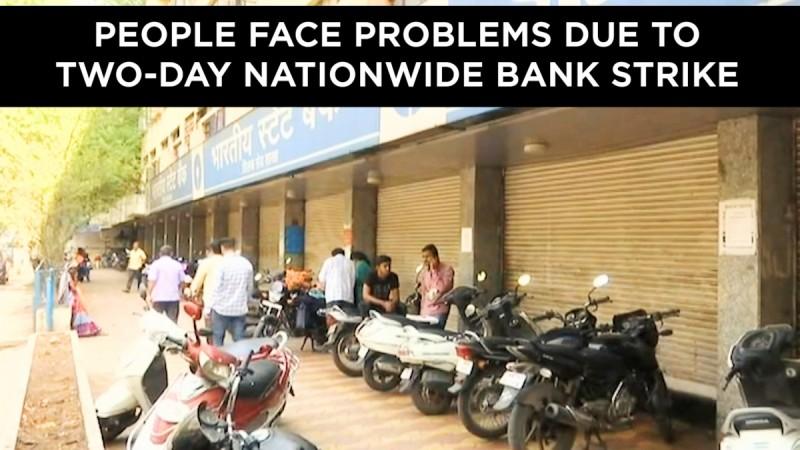

Banks will be shut on Monday, January 26, January on account of Republic Day and on January 27 as employees go on a nationwide strike.