If the guy going for the highest executive office in the country announces tax on its wealthy citizens, there's bound to be a ruckus in some quarters of the country.

Biden's campaign promises it will not raise direct taxes on households making under $400,000. But instead of Biden, his statements and promised tax policies, it's the RNC (Republican National Committee) Chair Ronna McDaniel who suddenly found herself in the midst of scrutiny.

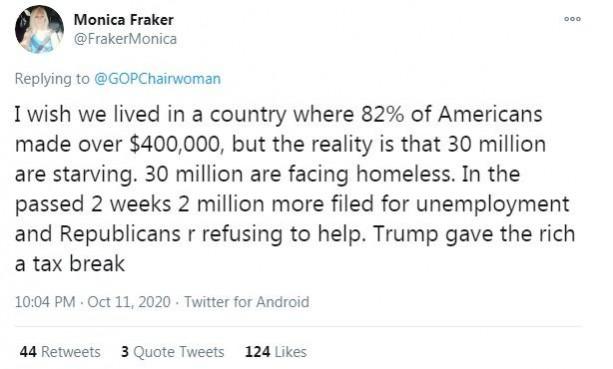

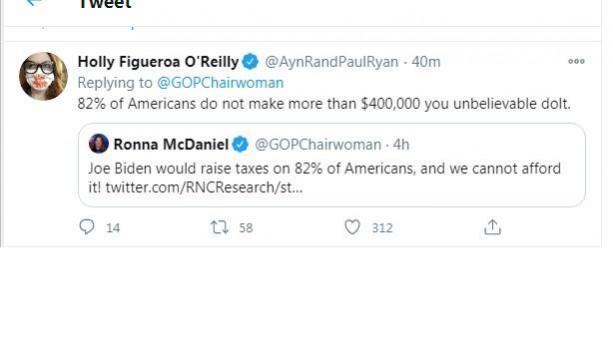

As Ronna McDaniel tweets, "Joe Biden would raise taxes on 82 per cent of the Americans, and we cannot afford it." It seemed that almost 82 per cent of the Twitter users pounced on the post, highlighting how 82 percent of America does not make more than $400,000 a year.

From reflecting frustration to nonchalance, the reactions got varied and funnier. While some were dead serious, others just resorted to 'seriously'? McDaniel continued to face Twitter backlash and all the possible forms of trolling, from sarcasm to downright name-calling.

What McDaniel said & what she meant

On the face of it, Ronna McDaniel's logic has a flawed assumption, but what she meant is that repealing Trump Tax Cuts will increase taxes on 82 per cent of the country, because that's the percentage of people who saved money on their taxes under the Trump's tax policy.

How much do Americans make anyway?

As per data from the Bureau of Labor Statistics pertaining time period as recent as second quarter of 2018, generally when people are at the peak of their careers in 40s to 50s, even then the median earnings for Americans no where touch near the $400,000 annual figure. The median earnings for Americans in the age group of 45 to 54 years is $51,272 annually.

The fine print of Biden's campaign

In the meanwhile, for the ones who have done the math, the proposed tax reforms by Biden will bring about distortion between higher income groups and social security system. Since social security benefits are based on average wages during your 35 highest-earning years, therefore social security benefit in America has always been an earned benefit.

However with Biden's intervention this is going to change, as those earning more than $400,000 would be injecting more into the system. While Biden has said that he will repeal the tax cuts as effectuated by Trump, but he also said that he'll repeal only the cuts given to households making more than $400,000. But what the 82 per cent of the America thinks of Biden's tax reforms can only be an estimate with the final figures available only post November 3.