Retail investors are often flooded with recommendations to buy or sell stocks, but given their limited financial acumen, they do not end up as smart investors. On the other hand, mutual funds (MFs), with crores of rupees at their disposal, have all the expertise to decide what to buy or sell to maximise returns.

Before we get to the details, here is the broad picture: the combined assets under management (AUMs) of India's 43 MFs fell marginally to Rs 17.55 lakh crore at the end of March 2017 when compared to Rs 17.89 lakh crore as of February 28, 2017.

Net inflows into ELSS tripled to Rs 2,906 crore from Rs 997 crore in February and Rs 1,166 crore in January 2017. The net inflows into equity schemes dipped to Rs 5,307 crore from Rs 5,465 crore in February 2017.

Some of the top-ranking MFs in India include ICICI MF, HDFC MF, Reliance MF, Birla Sun Life MF, Axis MF and SBI MF.

IDBI Capital Markets & Securities analyses how MFs shuffled their portfolios in March 2017:

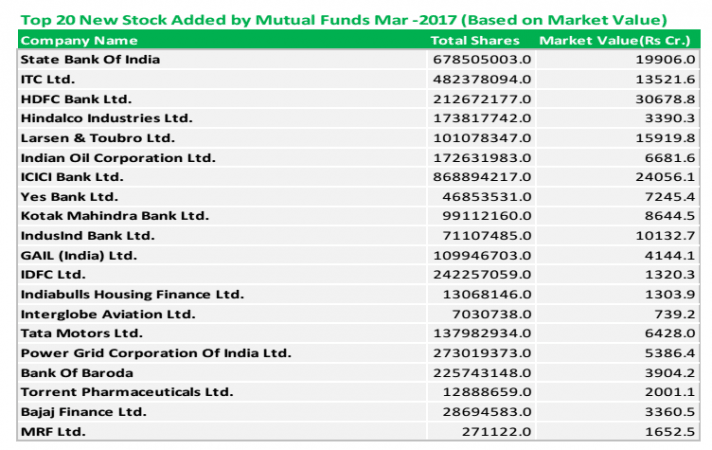

Top picks

Riding multiple themes, MFs bought heavily into select stocks such as State Bank of India (SBI), ITC, Indian Oil Corporation, Yes Bank, HDFC Bank, Larsen & Toubro, Tata Motors and Interglobe Aviation. Topping the list was private sector lender ICICI Bank, with fund managers buying 86.88 crore shares. The next was also a bank, public sector lender SBI, the total quantity being 67.85 crore shares.

Other top picks for fund managers during the month included IDFC, GAIL (India), ITC, Bank of Baroda, Power Grid Corporation, Hindalco Industries, Indian Oil Corporation and Larsen & Toubro.

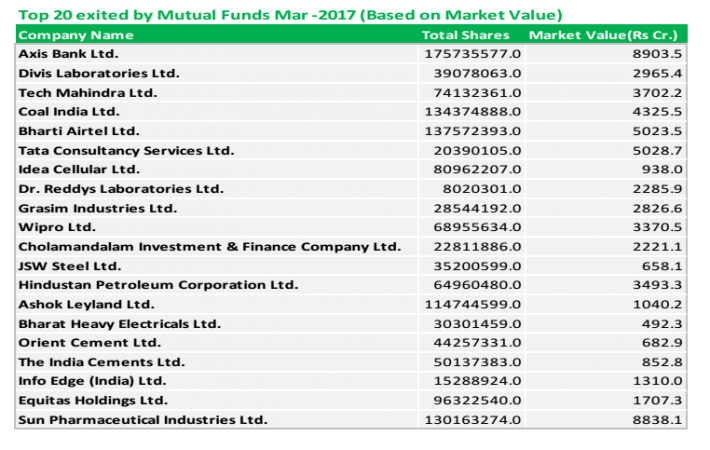

Top exits

Stocks that were dumped in large number by MFs during the month represented IT, banks, pharma, telecom and steel, among others. The biggest exit was private sector lender Axis Bank, with fund managers dumping 17.57 crore shares, followed by Bharti Airtel (13.75 crore shares). Other significant exits for MFs included Sun Pharma, Tech Mahindra, Coal India, Wipro, Ashok Leyland, Equitas Holdings, TCS, Idea Cellular and Divis Laboratories.