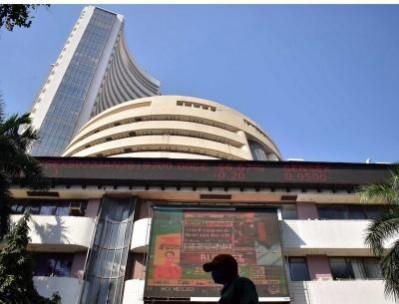

BSE Sensex gained 300 points on Monday although the market breadth is extremely negative. Sensex was trading at 74,183 points, up by 305 points. As many as 62 per cent of the stocks, 2388 stocks are declining while 31 per cent are gaining.

PSU shares tanked on Monday, with the sectoral index down 2.5 per cent. PFC was down 8.6 per cent, REC was down 6.2 per cent, MRPL was down 5.8 per cent, Canara Bank was down 4.7 per cent, BHEL was down 4.7 per cent, and PNB was down 4.2 per cent.

Among the Sensex stocks, Kotak Mahindra Bank was up 5.1 per cent, and TCS was up 2.1 per cent. Among the losers, Titan was down 6.2 per cent, SBI was down 3 per cent, and NTPC was down 2 per cent.

V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said the cut of 172 points on the Nifty last Friday is rumoured to be triggered by fears of changes in the long-term capital gains tax in the Budget after elections. "The Finance Minister quickly clarified that these are speculative. This clarification and positive global cues are likely to support the market in the near term," he said.

He added that the US jobs data for April has come lower than expected indicating a weakening labour market and a slowing economy. US unemployment has risen to 3.9 per cent in April. So the possibility of a rate cut by the Fed has again brightened. The decline in the dollar index to 105.8 and the cut in the 10-year US bond yield to 4.49 per cent augur well for the market.

"Positive comment by Warren Buffett that India is an untapped market with great potential is hugely important. FIIs can take a cue from that rather than reacting every time to changes in US bond yields.

Kotak Mahindra Bank is likely to respond positively to its impressive Q4 results. The Q4 auto results coming this week will be keenly watched by the markets and positive market responses are likely," he said.

(With inputs from IANS)