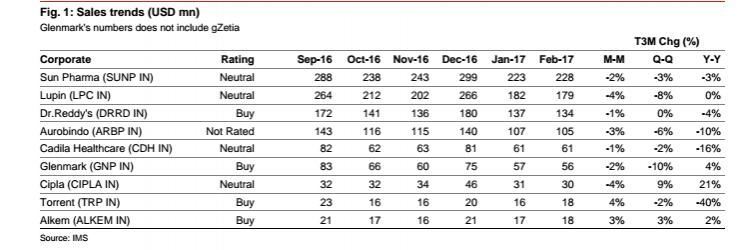

An analysis of sale of generic drugs in the US by Indian companies indicates that two of the nine firms saw their sales dropping over a six-month period.

Sun Pharma, Lupin, Aurobindo, Dr Reddy's Labs, Cadila and Cipla witnessed a fall in the range of 1 to 4 percent while Torrent and Alkem bucked the trend.

The analysis by Nomuara analysts Salon Mukherjee and Ayan Deb is based on data published by IMS every month.

The US is one of the top markets for Indian pharma companies; in 2015, India was one of the five sources of pharma imports for the US, valued at about $6 billion, according to the Department of Commerce.

According to Nomura analysts, deft handling of difficult product opportunities is extremely crucial for the companies in US to deal with this issue and grow successfully.

"To smooth out month-to-month variations, we highlight the trailing three-month (T3M) changes. The m-m change in T3M implies a change in sales between Dec-16-Feb-17 over Nov-16-Jan-17. The q-q change in T3M implies a change in sales between Dec-16-Feb-17 over Sep-Nov-16. The y-y change in T3M implies a change in sales between Dec-16-Feb-17 over Dec-15-Feb-16," the analysts wrote in their note released on Tuesday (March 28).

The BSE Healthcare index ended 0.19 per cent higher on Tuesday despite the Sensex closing 27 points lower at 29,620.

Sun Pharma gained 0.08 per cent to end at Rs 688, Dr Reddy's Labs closed 0.40 per cent higher at Rs 2,632, Aurobindo Pharma ended 0.12 per cent higher at Rs 675 and Cipla lost 0.90 per cent to close at Rs 592.

Reliance Industries bucked the trend and gained 3.93 per cent to end at Rs 1,319. Top Sensex losers were Axis Bank, ICICI Bank and HDFC Bank.

Foreign institutional investors (FIIs/FPIs) were net sellers of Indian equities worth Rs 296 crore on Tuesday, according to provisional data published by the National Stock Exchange.