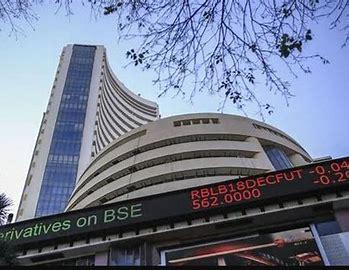

Indian equity market opened with marginal gains on Friday, taking a hint from global counterparts. The BSE Sensex opened at 62,690 points and was trading below the 62,500 mark, whereas the NSE Nifty-50 opened at 18,662 and currently trading above the 18,500 mark. Singapore-based SGX Nifty, an indicator of movement in Nifty-50, is trading close to the 18,800 mark.

However, after a brief rally in the early hours of trade, BSE Sensex plunged 200 points to 62,388 points as of 11 pm.

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said, "Equity markets will be looking forward to next week's crucial meeting of the Fed. Since the ECB and Bank of England meetings also are due next week, it would be important to know the leading central banks' view on the emerging economic scenario and their policy response. A decisive turn in the market is likely to happen only after that."

Some experts believe the Indian stock market is trading at above-average valuation but their hope comes from the future growth prospect of Indian companies in the next few quarters. The hope comes from the softening inflation expectations and improved margins from auto and FMCG companies.

In a Financial Express interview, Sahil Kapoor, Head of Products & Market Strategist at DSP Mutual Fund, said, "Unless there is an unknown trigger, sharp correction is unlikely; however, valuation adjustment will happen gradually over the next couple of quarters. The major risk visible at the moment is India's Balance of Payments. In the last six months, India has been running a trade deficit of $25 billion monthly. This comes out to be $300 billion annually, which is 8% of India's GDP. The high number is a risk because India's FII inflows have not been consistent, trade flows have been negative, and monetary policy is tight. This can result in a sharp reduction of liquidity, a concern for markets."

He believes that over the next three years, Indian equities will likely deliver healthy returns as earning growth will be supported by the Banking, Financial services and Insurance (BFSI) sector considering clean balance sheets, strong lending and credit growth.