Incredible but true! Some "over-smart" employees of the Jammu and Kashmir government claimed to have donated 50 percent of their salaries as donations to different political parties.

These employees have claimed to donate half of their salaries only to evade the Income Tax through forged means.

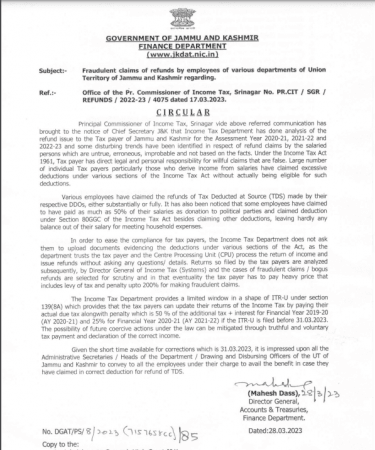

According to a circular issued by Mahesh Dass, Director Finance and Treasuries J&K Government, large numbers of such employees were identified during analyzing Income Tax refunds for the three financial years.

According to the circular, the Principal Commissioner of Income Tax, Srinagar through the communication has brought to the notice of Chief Secretary J&K that the Income Tax Department has analyzed the refund issue to the taxpayer of Jammu and Kashmir for the Assessment Year 2020-21, 2021-22 and 2022-23 and some disturbing trends have been identified in respect of refund claims by the salaried persons which are untrue, erroneous, improbable and not based on the facts.

"Under the Income Tax Act 1961, the taxpayer has direct legal and personal responsibility for willful claims that are false. A large number of individual taxpayers particularly those who derive income from salaries have claimed excessive deductions under various sections of the Income Tax Act without actually being eligible for such deductions", the circular reads.

Some employees claim to donate 50% of their salaries

It is mentioned in the circular that various employees have claimed the refunds of Tax Deducted at Source (TDS) made by their respective DDOs, either substantially or fully.

"It has also been noticed that some employees have claimed to have paid as much as 50 percent of their salaries as donations to political parties and claimed deduction under Section 80GGC of the Income Tax Act besides claiming other deductions, leaving hardly any balance out of their salary for meeting household expenses", circular further reads.

In order to ease the compliance for taxpayers, the Income Tax Department does not ask them to upload documents evidencing the deductions under various sections of the Act, as the department trusts the taxpayer and the Centre Processing Unit (CPU) to process the return of income and issue refunds without asking any questions/ details.

200 percent penalty on erring employees

Returns so filed by the taxpayers are analyzed subsequently, by the Director General of Income Tax (Systems), and the cases of fraudulent claims / bogus refunds are selected for scrutiny and in that eventuality, the taxpayer has to pay a heavy price that includes a levy of tax and penalty upto 200% for making fraudulent claims.

"The Income Tax Department provides a limited window in the shape of ITR-U under section 139(8A) which provides that the taxpayers can update their returns of the Income Tax by paying their actual due tax along with penalty which is 50 percent of the additional tax + interest for Financial Year 2019-20 (AY 2020-21) and 25% for Financial Year 2020-21 (AY 2021-22) if the ITR-U is filed before 31.03.2023," the circular reads.

The possibility of future coercive actions under the law can be mitigated through truthful and voluntary tax payment and declaration of the correct income.

Given the short time available for corrections, which is 31.03.2023, it is impressed upon all the Administrative Secretaries / Heads of the Department / Drawing and Disbursing Officers of the UT of Jammu and Kashmir to convey to all the employees under their charge to avail the benefit in case they have claimed in the correct deduction for a refund of TDS.