As part of a rescue deal of the Yes Bank, the State Bank of India (SBI) has shown interest in investing 24.5 billion rupees in the troubled lender to buy a 49 per cent stake.

SBI Chairman Rajnish Kumar told reporters at a press conference today (March 7) that the rescue of Yes Bank was a "must," less than two days after the Reserve Bank of India (RBI) took control of the capital-starved bank and placed it under a one-month moratorium and capped the monthly withdrawal limit for depositors to Rs 50,000 per account.

"The plan has been received by SBI and the legal team is working on the plan. We had informed through the stock exchange that SBI board has given in-principle approval of exploring possibility of picking up a stake of up to 49 per cent in Yes Bank," Rajnish Kumar said.

"There are many potential private equity investors , there some good names , we are looking at co-investors . There are certain regulatory norms for anybody who wants to go beyond 5 per cent (stakes). But there is considerable investor interest," the SBI chairman added.

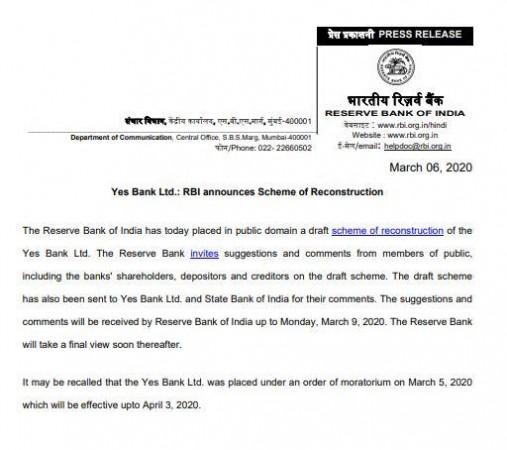

RBI issues draft revival plan for Yes Bank

The RBI took over from the bank's board for 30 days, imposed limits on withdrawals and said it would work on a revival plan.

The draft plan has come a day after the banking regulator superseded Yes Bank board and appointed an administrator.

READ: Have an account with Yes Bank? Here's what you can do

The RBI's draft plan has said that Yes Bank's new share capital will be Rs 5,000 crore with 2,450 crore equity shares of Rs 2 each.

As per the plan placed in the public domain for comments, the investor bank would be required to invest in the equity of reconstructed Yes Bank to the extent that post infusion it holds 49 per cent shareholding in the bank at a price not less than Rs 10 (face value of Rs 2) and premium of Rs 8.

Moreover, the Yes Bank employees will continue to work under the same remuneration and on the same terms and conditions of services as before for at least a period of one year.

(With agency inputs)