The central government on Tuesday imposed a moratorium on Tamil Nadu-based private sector lender Lakshmi Vilas Bank. With this announcement, the bank imposed a withdrawal cap of Rs 25,000 for a month. According to the information of the Finance Ministry, customers of the bank will not be able to withdraw more than Rs 25,000 from November 17 to December 16. However, with the permission of RBI for medical treatment, fees for the payment of higher education, and marriage expenses, approval will be allowed to withdraw more money.

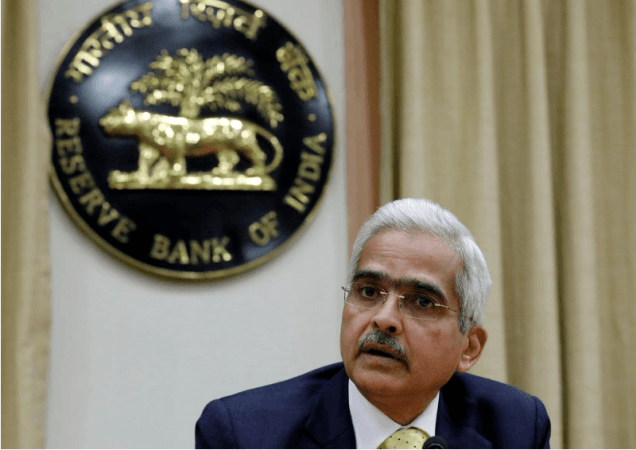

An order from the finance ministry read, "Reserve Bank has come to the conclusion that in the absence of a credible revival plan, with a view to protect depositors' interest and in the interest of financial and banking stability, there is no alternative but to apply to the Central Government for imposing a moratorium under section 45 of the Banking Regulation Act, 1949."

It is to be noted that in September this year, the Reserve Bank of India formed a three-member committee under the leadership of Mita Makhan to run the cash-strapped bank. In fact, the bank was in urgent need of capital due to a fall in assets and had been scrambling to find a buyer for the past one year. According to the report, the troubles of the bank started increasing in the year 2019 when the RBI rejected its proposal to merge with India bank Finance.

Moreover, last year RBI imposed a cap on withdrawal for six months from Punjab and Maharashtra Cooperative Bank. The RBI set the withdrawal limit to Rs 25,000, which was later extended. In fact, the central bank took this step after a case of financial irregularity came out against PMC Bank. The Reserve Bank also imposed several other restrictions.

Merger with DBS Bank

Soon after the moratorium was imposed, the central bank unveiled a draft to merge Lakshmi Vilas Bank with DBS Bank India Ltd. (DBIL). The RBI announced the merger scheme and said DBIL would bring in additional capital of Rs. 2,500 crore in advance to support the merged entity's credit development.

!['Lip lock, pressure, pyaar': Vidya Balan- Pratik Gandhi shine in non-judgmental infidelity romcom Do Aur Do Pyaar [ Review]](https://data1.ibtimes.co.in/en/full/797104/lip-lock-pressure-pyaar-vidya-balan-pratik-gandhi-shine-non-judgmental-infidelity-romcom.jpg?w=220&h=138)