The Reserve Bank of India (RBI) on Friday reduced the repo rate by 40 basis points to 4 per cent in an effort to further boost liquidity in the economy which has been reeling under the impact of COVID-19 induced countrywide lockdown.

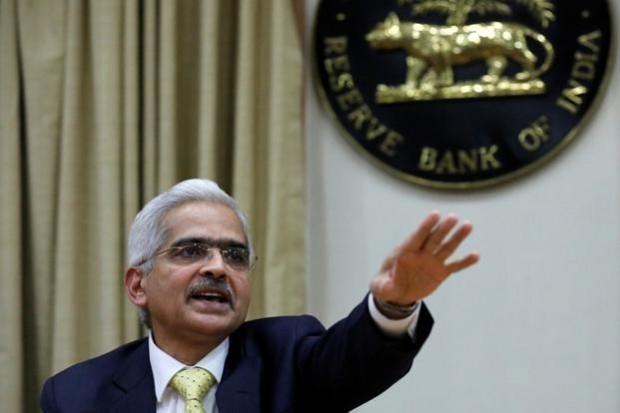

As a result, the reverse repo rate stands at 3.35 per cent, said RBI Governor Shaktikanta Das. Five of six Monetary Policy Committee (MPC) members voted in favour of the rate cut. Repo rate is the rate at which a country's central bank lends money to commercial banks, and the reverse repo rate is the rate at which it borrows from them.

Shaktikanta Das also said that the headline inflation is expected to fall below RBI's target of 4 per cent by the third or fourth quarter. He also said that a lot will depend on how India can gradually ease the lockdown and how quickly the Covid-19 curve can be flattened.

Key takeaways from RBI Governor's briefing today:

- Industrial production shrank by close to 17% in March with manufacturing activity down by 21%. The output of core industries contracted by 6.5%.

- Amidst this encircling gloom agriculture and allied activities have, however, provided a beacon of hope on the back of an increase of 3.7% in food grain production to a new record.

- India's foreign exchange reserves have increased by 9.2 billion during 2020-21 from 1st April onwards. So far, up to 15th May, foreign exchange reserves stand at 487 billion US dollars.

- The GDP growth in 2020-21 is expected to remain in the negative category with some pick up in the second half.

- Measures announced today can be divided into 4 categories: to improve the functioning of markets, to support exports&imports, to ease financial stress by giving relief on debt servicing&better access to working capital&to ease financial constraints faced by state govt.

- Three-month moratorium we allowed on term loans&working capitals we allowed certain relaxations. In view of the extension of the lockdown&continuing disruption on account of #COVID19, these measures are being further extended by another 3 months from June 1 to Aug 31.

- The Group Exposure Limit of banks is being increased from 25% to 30% of eligible capital base for enabling the corporates to meet their funding requirements from banks. The increased limit will be applicable up to 30th June, 2021.

- It has been decided to relax rules governing withdrawal from Consolidated Sinking Fund (CSF) while at the same time, ensuring depletion of the fund balance is done prudently. It will enable states to meet about 45% of redemption of their market borrowings which are due in 2020-21

Watch the live briefing:

#WATCH LIVE: Reserve Bank of India (RBI) Governor Shaktikanta Das holds a briefing. https://t.co/wN6XQckKe1

— ANI (@ANI) May 22, 2020

(to be updated further)