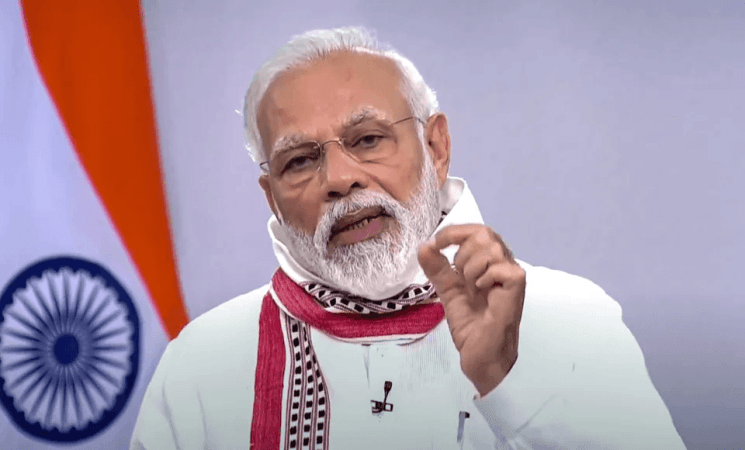

In response to the lockdown extended till May 3 and a seven-point agenda stated by the Prime Minister Narendra Modi early this morning, requesting people to maintain vigil and adhere to social distancing norms strictly. He also suggested that low-risk areas may be permitted to open up for certain specific activities from 20th April 2020 onwards.

PM Modi said, "Until 20th April, every town, every police station, every district, every state will be evaluated on how much the lockdown is being followed. Areas that succeed in this litmus test, those which will not be in the hot-spot category, and will have less likelihood to turn into a hot-spot may be allowed to open up select necessary activities from 20th April. However, permissions will be withdrawn immediately if lockdown rules are broken, and if there is a threat of the spread of Coronavirus."

Besides focusing on protecting and meeting the needs of the daily-wage workers through Pradhan Mantri Gareeb Kalyan Yojna during these crisis times, the PM urged employers and businesses to be "compassionate towards the people who work in every individual business or industry. Do not deprive them of their livelihood."

MSMEs face liquidity crunch

Calling out the government for lack of liquidity measures for the MSMEs, T V Mohandas Pai, Chairman, Aarin Capital spoke to CNBC-TV18 earlier today saying, "I think all of the country, everybody needs DBT (Direct Benefit Transfer). While the government of India is giving Rs.500 to 20crore women which is not enough, besides free ration and gas etc.The big issue to keep jobs, apart from focusing on the poor today, is the lack of liquidity for the MSMEs."

While RBI has announced a liquidity boost of Rs 3.74 lakh crore amid the Covid-19 crisis scenario, the money is not going to the users, Pai asserts. "Now we are finding that big companies are raising bonds at cheaper rates. This is not meant for big companies, it is meant for MSMEs to keep their jobs."

Meanwhile, the SBI chairman has increased the working capital limits by 10%, which Pai thinks, should have been increased by 20%. "We need a Rs 50,000 crore credit guarantee fund to guarantee the first 10% loss for any money given to the MSMEs, and others to increase the working capital. The banks will not lend unless the government gives a credit guarantee."

So it is required of the government to step up efforts today, because "it is a liquidity matter and not a solvency matter." The MSMEs need liquidity to last until the business revives itself. "If they do not have liquidity then they will start laying off people, and once they layoff people, it is difficult to start again because many of them may die. 25 to 30 percent of the MSMEs will die."

According to another report, 25% of the MSMEs surveyed have money for only one month, and another 25% have money for 3 months, Pai mentioned. "Now since a month is over, we need massive liquidity support. Banks will not lend unless there is a credit guarantee provided by the government. It's the responsibility of the RBI to make sure that the money goes to the MSMEs, it cannot wash its hands off the situation and sit back."

Citing examples of the measures taken by the US Fed and the UK government to help businesses tide over the Covid-19 crisis, Pai said that, "While the government will not be able to provide a salary guarantee like other developed nations, it must at least offer liquidity support to the MSMEs."

Covid-19 crisis coping measures: What is the status of refunds due to people?

Pai states, "There is perhaps about Rs 1 lakh crore refunds due to people, which include income tax refund, GST refunds, and 14% guaranteed fund to the states. The Finance Minister Nirmala Sitharaman in her recent address ordered upto 5 lakh to be released. But, Rs 5 lakh is nothing for MSMEs."

Pai urges the government to release the whole tax refund saying, "It is our money for God's sake, and not the government's money. Give the money back. Why are you holding onto our money? Look at the absurdity, they pay some 6% interest to hold onto the people's money and we have to pay some 12 to 18% interest in case you don't pay. So they are clearly exploiting the situation, which is totally wrong. I think they must give back the people's money which is due to them. It is not their money."

The states have a 14% guarantee which is a contract, a commitment to the Federal government, and it is important for the government to honour the commitment. Pai spoke with ire, "Borrow money and give it back to the states. Do not make states beg for the money. While enhanced liquidity and packages might come later, the key thing today is how do we survive for the next 15 to 20 days? How do we make the payroll for April?"

With the PM extending lockdown till May 3, businesses will have to make the payroll for April and if people start getting laid off, Pai fears "There will be a human catastrophe. The whole year until March the GDP maybe negative - 2.5%, because agriculture accounting for 17% of GDP may grow at 3 to 3.5%, and industry sector that accounts for 25% of GDP, the growth will be zero or negative, while the services industry accounting for about 60% of GDP, will grow at about 3 to 4%, while it normally grows 7%. Barring the government sector which is 15% of services, where we pay tax and they get salaries - everything will be negative. All the services will be devastated so we could have a negative growth."

Pai suggests that the government should be prepared to not let it go down. He says, "The government must open up infrastructure. It is time for the Government to spend on roads, ports, and get the infrastructure sector going, pay back the money that is due, ask them to start working, since most of the areas are free and there are not many people going around. Social distancing can thus be followed and this in turn will put some money into the economy."

The infrastructure budget for this year is Rs 3.5 to 4 lakh crores. As there will be no restrictions or stoppages, the infrastructure sector can keep working to employ people at airports, and port construction activities that will pump some money into the economy.

Tapping into the RBI reserves to overcome the liquidity crunch

Pai expresses ire with the Government saying, "There are about 8 crore people in EPFO and ESI (monthly figures), of which 4 crore people are employed on contract. If the lockdown is planned and within the next 30 days, we can open up, the work can start again then, the labour contractors need cash in hand. While everyone will abide by the PM appeal to not layoff workers, where is the money to pay the contracted labour? If they do not have cash to pay, how will they live? It is the question of liquidity, not solvency. You are not giving a grant."

Citing examples of many startups that have taken pay cuts and some laying off people because previous refunds are due, the situation today is rather unfair. Pai urges the government to give back the refunds due to people and questions, "why upto Rs 5 lakh? 5 lakh is ridiculous. It is our money, give back the whole refund of IT and GST refunds. While you can always claim it back later, because that money belongs to people."

Calling out to the government for having taken the money from people in advance, Pai says, "It is time now to give it back. At least, if the government starts doing this, pumping up liquidity where the money belongs to the people and taxpayers, this will send a good signal. Now the policy statement about not laying off has to be supported with some action from the government economically."

Appreciating efforts made by the new UK chancellor who has issued $300 billion of loan guarantee, the US offering $500 billion of loan guarantee, Pai states, "These governments are giving money to keep people on the payroll, since all of them know that jobs are the most important thing. When we are out of the Covid-19 crisis and people do not have jobs - they are the most vulnerable people because their ability to keep going is not more than 2 or 3 months since they do not have enough savings. You cannot expect a person to live on Rs. 1500 to Rs 2000 per month, Rs 2000 of cash, some rations and gas, which is all good in rural areas, wherein some get additional income. We need support for the next 30 to 60 days, and it is an urgent appeal to the government."

To help overcome the liquidity crunch caused by the Covid-19 outbreak, RBI has to step up efforts. Pai suggests that "The Government should look into the RBI reserves. RBI has got about Rs 7 lakh crores of reserves, and Rs.3 lakh crores can be taken from it for the budget, then transferred to the government. Why should the RBI have such a high-level of reserves? After all the RBI is owned fully by the government, its sovereign is the government and the government guarantee is the RBI. Then, why should the RBI have these kinds of reserves? RBI can transfer funds from the balance sheet to the government."

Time to step up efforts and tide over the Covid-19 economic crisis situation

Pai calls out to RBI saying, "These are desperate once in a lifetime measures. If the RBI does step up to rescue the people of this country, when we are in trouble, especially when people do not have money, it is not right. Every central bank in the world is making efforts. It is time for the government to instruct RBI to give back the people's money, it's our money anyways. It is the creation of statute and not an impeachment or a policy measure that has to be taken."

With Rs 6 lakh crores of RBI reserves, and gold value reserves of Rs 1 lakh crore, which means the difference between the book value and the market to the gold, the difference is Rs.1 lakh crore. The gold is given by GoI to them at historical rates. Pai thinks, the times call for drastic measures from the Government, if we do not have enough funds, then we should tap into the RBI reserves during emergencies.

![BJP fields Tashi Gyalson for Ladakh; drops sitting MP [details]](https://data1.ibtimes.co.in/en/full/797185/bjp-fields-tashi-gyalson-ladakh-drops-sitting-mp-details.jpg?w=220&h=138)