With Covid-19 or coronavirus declared as a global pandemic by the World Health Organisation (WHO), the question arises if the Life Insurance policy will cover death claims of Covid-19 patients? Also, will an individual be able to purchase a policy after contracting the virus or not? How will death claims and other claims be settled by insurance companies during these crisis times? What are things to bear in mind when buying a Coronavirus-covering life insurance plan?

The Life Insurance Council announced that the clause of 'Force Majeure' will not apply in the case of Covid-19 cases, and death claims will be accepted by life insurance companies. Force Majeure is a clause covering unforeseen circumstances, an unanticipated event or effect that cannot be controlled like natural disasters, labour unrest or strikes, war or war-like situations, global epidemics, pandemics, etc.

What is Force Majeure?

The "force majeure" clause will not be applicable in any of COVID-19 death claims by both private firms and state-run insurance providers.

According to a press release from the Life Insurance Council, "This step was taken to reassure customers who had reached out to individual life insurance companies seeking clarity on this clause in their contract as well as to dispel rumours to the contrary. All life insurance companies have also communicated to their customers individually in this regard."

With the life insurance industry stepping up efforts to assist customers during gloomy times, the insurance companies will be willing to cover Covid-19 deaths as there is no clause declared in contracts of insurance providers either. So, as long as the policyholder declares all details correctly to the insurance company, the death claims can be duly settled.

In case of continuance of the force majeure events that affects the normal functioning of the company, then the insurer can temporarily suspend claims in case of strikes, natural calamities, war, riots, civil unrest and bandhs.

S N Bhattacharya, Secretary-General, Life Insurance Council said in its press release, "The spiraling global and local impact of COVID-19 pandemic has emphasized the fundamental need for life insurance in every household. The life insurance industry is taking every measure to ensure that the disruption caused to policyholders, due to the lockdown is minimal, by providing them uninterrupted support digitally, be it for honoring death claims related to COVID-19 or for servicing their policy. We reiterate that all life insurance companies stand by their customers in these difficult times and the customer should not be swayed by misinformation or misrepresentation."

How will Covid-19 death claims be processed?

If the life insurance policyholder passes away due to Covid-19, then the death benefit of the sum assured will be given to the nominee of the policyholder or the beneficiary nominee, only if all details are declared and a valid insurance claim is filed. Most life insurance companies do not explicitly deny payment of death benefits to nominees in case of death caused by any illness.

However, it's important to bear in mind the conditions of the life insurance policy, benefits, and add-ons that will be paid out if the conditions are met as per terms of the clause. For instance, claims may not be entertained in case of life insurance policies, wherein medical advice was not followed strictly by the policyholder.

There are no exclusions for existing life insurance policy holders in case of death due to Covid-19 according to the LIC, but new life insurance policy holders could face some exclusions in certain policies not covering pandemics or natural disasters.

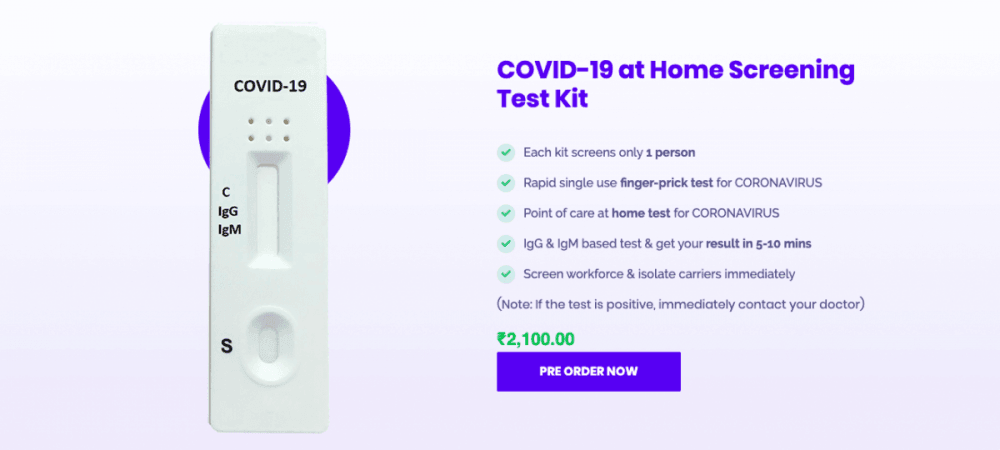

Thinking of buying a new policy now? Know the insurers offering Covid-19 cover

In case you're planning on buying a new policy at this point in time, then it's important to note that insurers determine your policy acceptance and the premium is decided on your policy depending on your health and medical history. There are chances that your insurance company may even put your application on hold or reject your new policy application, in view of the fact that perhaps you may have already contracted Covid-19.

There are some things you should know before you buy a new Covid-19 policy plan:

- A comprehensive LIC plan is a traditional policy that will offer you benefits that cover hospitalisation and other medical expenses, while a Covid-19 specific plan will offer benefits at an affordable premium. The disadvantage with Coronavirus specific life insurance plan is it will cover only the Covid-19 policyholder and not provide comprehensive coverage to assist you with any other diseases in times of need. Hence if you do not have a health insurance policy yet, buying a comprehensive health plan makes all sense.

- Read the inclusions and exclusions carefully before buying a Coronavirus policy or comprehensive life insurance plan. Analyze the pros and cons of fixed benefit health insurance plan vs. the regular indemnity health insurance plan. Corona-specific plans may be good to supplement your current life insurance plans, but if you are looking at meeting a short-term requirement, then it all depends.

- Buy a comprehensive plan with a higher sum assured to meet all requirements. Adequacy is the key to making the right choice.

- Not all policies are designed to cover pandemics, epidemic and other unforeseen health hazards. Enquire with your insurer if pre and post hospitalisation expenses that include Covid-19 testing, and other medical expenses will be covered by your particular policy.

- If you choose to buy a policy now, there could be a waiting period under which no diseases will be covered for a brief time. Take this into account before you apply. Also, some policies might not cover people with recent international travel history, especially in cases of Covid-19 suspects under quarantine.

- Most insurance companies have a provision for exclusion of pre-existing diseases, so they might verify if Covid -19 virus has not originated before the policy purchase date.

To ensure the claim filing process is smooth for policyholders during the lockdown period, most insurance companies have ramped up their digital services to ease hassles for customers.

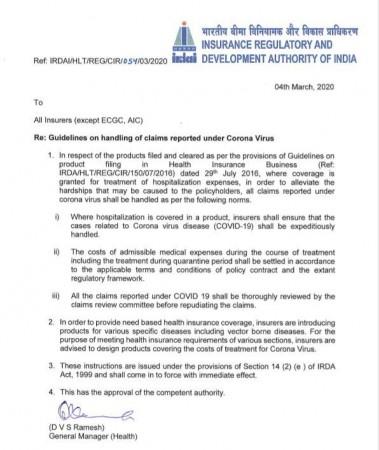

Measures by IRDAI to combat Covid-19 crisis

The Insurance Regulatory and Development Authority of India (IRDAI) has also provided an additional grace period of 30 days for payment of renewal premium in case of motor third party insurance and health insurance policies.

As regards settlement options for unit-linked policies maturing up to May 31, life Insurers may offer settlement options in accordance with Regulation 25 of IRDA (Linked Insurance Products) Regulations, 2013. This one time option is regardless of whether such an option exists or not in the specific product. The Life Insurers, however, have to exercise all due care and diligence to explain clearly the possible downside risk of continued fluctuation of fund value based on daily NAV and clear consent has to be obtained from the policyholder.

Also, Covid-19 claims should be processed using simplified, expedited claim procedures by insurance companies. Also, efforts are made to process claims within the prescribed period as mentioned. In case insurers have issued travel insurance policies which were or are valid between March 22 and April 30, 2020, an option will be provided to the policyholders to defer the date of travel without any additional charge.