Announcing relief to the taxpayers, the finance ministry has announced the extension for Income Tax return (ITR) for the financial year 2019-20. The ministry has given another extension for a month and the new deadline for filing ITR is 31 December 2020.

In a statement, Central Board of Direct Taxes (CBDT) said, "The due date for furnishing of Income Tax Returns for the taxpayers [for whom the due date (i.e. before the extension by the said notification) as per the Act was July 31, 2020] has been extended to December 31, 2020." The CBDT argued that the deadline has been extended to "provide more time to taxpayers for furnishing of Income Tax Returns".

Second Extension in deadline

Notably, this is the second time that the ITR reporting deadlines have been extended by the Ministry of Finance. In May, in the aftermath of the coronavirus outbreak, the Finance Ministry extended the ITR filing deadline to 30 November 2020. Moreover, the ITR filing deadline has been extended by two months to 31 January 2021 for all taxpayers whose accounts need to be audited.

How to file ITR?

There are three options for the taxpayers to file ITR. It can be filled offline, online, and software in three ways. Of these, all types of ITR forms can be filled in offline mode but only ITR-1 and ITR-4 can be filled online. After this, there is software as the third option, which can be said to be the best. Here's how to make an online submission of ITR.

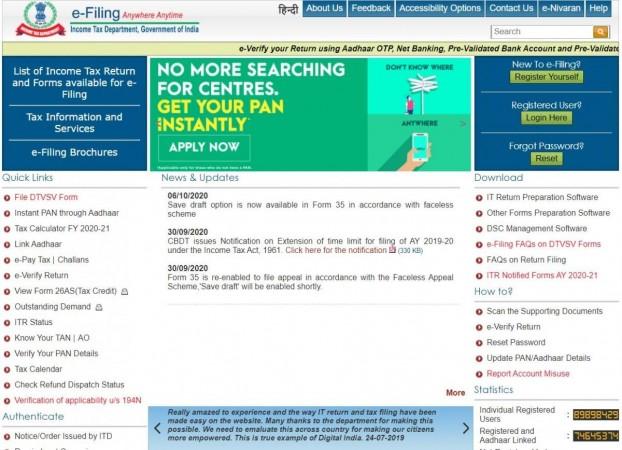

Visit the Income Tax Department's website. http://www.incometaxindiaefiling.gov.in

Log on to the portal. First-time users will have to register themselves.

One will need to keep one's user ID, password, and date of birth ready.

When signed in, click on the option which says "Filling of Income Tax Return" One needs to select the ITR form type based on the category they fall in. Besides, that submission year will also have to be chosen.

Fill in the rest of the details as required and hit the submit button. The system will generate a message of acknowledgement and the same will also be sent to your registered e-mail id with the Tax department. Finally, File your Income Tax Return