India is set to witness a baseline GDP growth of 6.5 percent as per real terms in 2023-24, according to the economic survey for 2022-23, which was laid in Parliament by Finance minister Nirmala Sitharaman on Tuesday.

The survey said that in real terms, the economy is expected to grow at 7 percent in the current financial year (2022-23), a downward revision from 2021-22, when the growth was 8.7 percent in the previous financial year (2021-22).

The fiscal deficit for 2022-23 is estimated to be 6.4 percent of the GDP, the document said.

"Despite the three shocks of Covid-19, the Russian-Ukraine conflict and the central banks across economies led by Federal Reserve responding with synchronised policy rate hikes to curb inflation, leading to appreciation of dollar and widening of the current account deficits (CAD) in net importing economies, agencies worldwide continue to project India as the fastest-growing major economy at 6.5-7.0 per cent in 2022-23," the survey noted.

According to the economic survey, India's economic growth in 2022-23 has been mainly led by private consumption and capital formation and these have helped generate employment as seen in the declining urban unemployment rate and in the faster net registration in employee provident fund.

Moreover, the world's second-largest vaccination drive involving more than two billion doses also served to lift the consumer sentiment that may prolong the rebound in consumption. Still, private capex soon needs to take up the leadership role to put job creation on a fast track, the survey said further.

The optimistic growth forecasts have been mainly projected on the basis of several positive factors like rebound of private consumption which gave a boost to production activities, higher capital expenditure, near-universal vaccination coverage enabling people to spend on contact-based services, such as restaurants, hotels, shopping malls and cinemas, as well as the return of migrant workers to cities to work in construction sites leading to a significant decline in housing market inventory.

The survey, which highlights the economic performance of key sectors during the ongoing fiscal, further noted that strengthening of balance sheets of corporates, a well-capitalised public sector banks ready to increase the credit supply and the credit growth to the micro, small and medium enterprises (MSME), were some of the other aspects which have boosted optimism for a healthy growth projection in 2023-24.

Apart from housing, construction activity in general has significantly risen in 2022-23 as the much-enlarged capital budget (capex) of the Central government and its public sector enterprises is rapidly being deployed, the survey said, adding that if one goes by capex multiplier, the economic output of the country is set to increase by at least four times the amount of capex.

"States, in aggregate, are also performing well with their capex plans. Like the Central government, the states also have a larger capital budget supported by the Centre's grant-in-aid for capital works and an interest-free loan repayable over 50 years," it noted.

Key highlights of Economic Survey:

Chief Economic Advisor V . Anantha Nageswaran has noted that India's economy is poised to do better in the remainder of this decade. Here are the key highlights from Chief Economic Advisor's presentation on Economic Survey:

Recovery of the economy is complete; non-banking and corporate sectors now have healthy balance sheets, hence, we don't have to speak of pandemic recovery anymore, we have to look ahead to the next phase.

Leverage ratio in the corporate sector went very sharply in the first decade of millennium, the second decade was thus a payback time, excessive credit growth had to be adjusted for in the second decade, balance sheets now have been repaired, & credit growth is picking up.

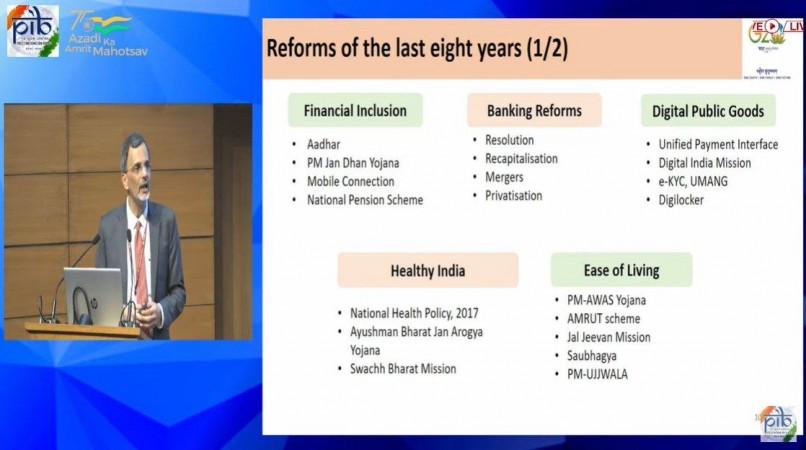

Reforms of last eight years spanning multiple dimensions including digital, social and physical infrastructure were happening even as banking clean up was going on.

(With agency inputs)