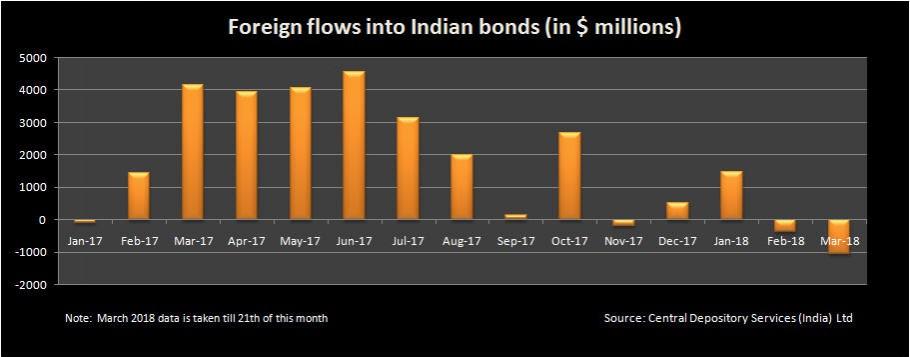

Indian bonds, once regarded as hot emerging market play, are losing their allure with foreign investors, resulting in monthly fund outflows hitting their highest level in nearly 15 months.

Foreign investors have sold a net $1.12 billion in Indian debt this month - the highest since December 2016, and are now on the verge of turning net sellers for the year.

The outflow comes as a surprise after the country received about $26.3 billion in inflows last year on the back of higher bond yields and stable currency.

Analysts attribute rupee weakness as one of the major reason for the change in investor sentiment. The partially convertible currency has lost near 2 percent against the US dollar this year.

A fall in local currency erodes returns for foreign investors at a time when rising US interest rates narrow the yield differentials.

The Federal Reserve's decision to raise interest rates and forecast a steeper path of hikes in 2019 is putting pressure on emerging-market currencies, like the rupee.

Adding to the woes is the prospect of higher interest rates, quickening inflation and a widening fiscal deficit as government loosens its purse strings to finance projects ahead of next year elections.

Meanwhile, the inability of state-run banks to buy government bonds amid widening treasury losses also reduced confidence in the country's debt.

State-run lenders have been selling Rs 5.30 billion of government debt on average every day this year, according to Clearing Corp of India.

"The past reliance of Indian bond markets on banks suggest a new investor class is needed to absorb upcoming bond supply," Nomura strategists wrote in a recent report.

Banks hold about 30 percent of the government bonds while foreigners own about 7.5 percent.

(With inputs from Reuters)