With just two days to go for the roll-out of the Goods and Services Tax (GST), the uniform tax system across India, there seems to be a lot of confusion on the new pricing of various products, including bikes and scooters.

While many two-wheeler makers in the country have already announced a price revision of their models to pass on the expected benefits of GST to customers, there are other models that are expected to see an increase in the price. So how is all this being calculated?

Also Read: 2017 Bajaj Pulsar NS160 to be priced at Rs 85,000; bookings open ahead of July launch

Although it was thought earlier that the new tax regime would increase the pricing of scooters and bikes, after several rounds of calculation, two-wheeler makers now seem to be convinced that some of their offerings will get cheaper.

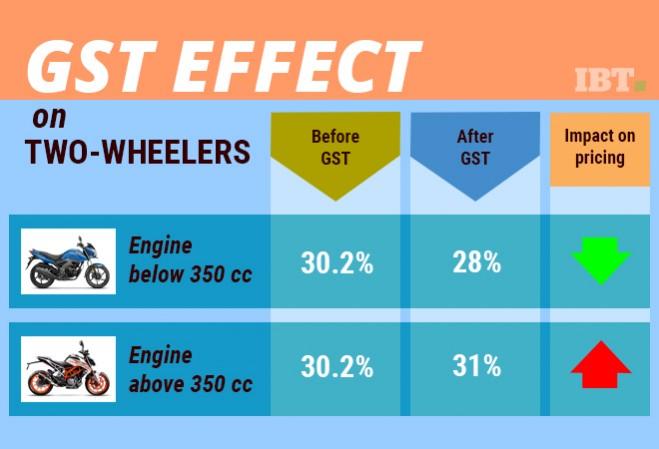

Here is a break-up of how the tax on two-wheelers, both scooters and bikes, is being calculated under GST and how this will reflect on the pricing of the models.

GST impact on two-wheelers

When it comes to two-wheelers, the classification is done based on the engine capacity of the model and there are two types — two-wheelers with less than 350cc engine and two-wheelers with engines above 350cc.

Less than 350cc engine

All the scooters, except Aprilia SRV 850 ABS, which is also the most expensive scooter in India, fall in this category. While the current tax incidence of this category takes the total to 30.2 percent, with 12.5 percent Excise Duty, one percent NCCD (National Calamity Contingency Duty), 12.5 percent VAT (Value Added Tax) and 2 percent CST (Central Sales Tax), under GST, the tax rate of the scooters and bikes in this segment will go down to 28 percent, which is lower by about 2 percent than the current tax slab. Commuter bikes and models like Royal Enfield Classic 350, KTM 200 Duke, KTM RC 200 and others will hence see a price cut.

Above 350cc engine

In the existing (pre-GST) system, bikes above 350cc engine attract a tax rate of 30.2 percent. With GST in effect from July 1, motorcycles with engines over 350cc will attract an additional cess of three percent, taking the total tax rate to 31 percent, which is a slight increase from the current rate. Bikes like Royal Enfield Classic 500, Kawasaki Z900, KTM Duke 390, entire BMW Motorrad and Ducati range and Bajaj Dominar 400 are likely to see a hike in prices.

What will come cheaper?

Two-wheeler makers like Bajaj, UM Motorcycles and Honda are offering steep discounts on their range of models to pass on the expected benefits of GST to customers. Honda Motorcycle and Scooter India (HMSI) is set to revise the prices of its popular models in India, such as the Activa and Unicorn. The prices of the Honda models in the country would go down in the range of 3-5 percent from July 1, on the same day as the roll-out of GST.

Bajaj has already reduced the prices of its bikes by up to Rs. 4,500. UM Lohia Two Wheelers Pvt. Ltd, the Indian subsidiary of American motorcycle maker UM Motorcycles, has slashed the prices of its cruiser motorcycles by up to Rs. 5,700. TVS Motor Company and Royal Enfield have also decided to pass on the GST benefits to their customers in the country. The prices of Royal Enfield models will go down in the range of Rs. 1,600 to Rs. 2,300 (on-road prices Chennai). The price cut may vary from state to state.

!['Lip lock, pressure, pyaar': Vidya Balan- Pratik Gandhi shine in non-judgmental infidelity romcom Do Aur Do Pyaar [ Review]](https://data1.ibtimes.co.in/en/full/797104/lip-lock-pressure-pyaar-vidya-balan-pratik-gandhi-shine-non-judgmental-infidelity-romcom.jpg?w=220&h=138)