It's the first death anniversary of Arun Jaitley and the finance ministry described him as one who 'played a key role' in the GST implementation. To commemorate the occasion, the ministry released information on the successes of the GST era.

GST implementation began in 2017. It has had its fair share of criticism, especially on certain sectors and commodities. However, the finance ministry released today certain areas where it has improved the situation.

Finance ministry on expansion of taxpayer base

The finance ministry issued a series of tweets on Monday morning, "On the first death anniversary of Shri Arun Jaitley, we pay our respects and remember his lasting contribution to nation-building and the legacy he left behind as Union Finance Minister during 2014-19."

Further, "As we remember Shri Arun Jaitley today, let us acknowledge the key role he played in the implementation of GST, which will go down in history as one of the most fundamental landmark reforms in Indian taxation."

The goal of the GST was to regularise a standard rate of taxation across India, "Before GST, the combination of VAT, Excise, Central Sales Tax and the cascading effect of tax on tax resulted in the standard rate of tax being as high as 31% in many cases," the ministry said in a tweet on Monday morning.

However, the ministry has said following the implementation of the GST taxpayer base has grown over the years from 65 lakh before implementation to 1.24 crore, "The multiple markets across India, with each state charging a different rate of tax, led to huge inefficiencies and costs of compliance. Under GST, compliance has been improving steadily. The taxpayer base has almost doubled to 1.24 crore."

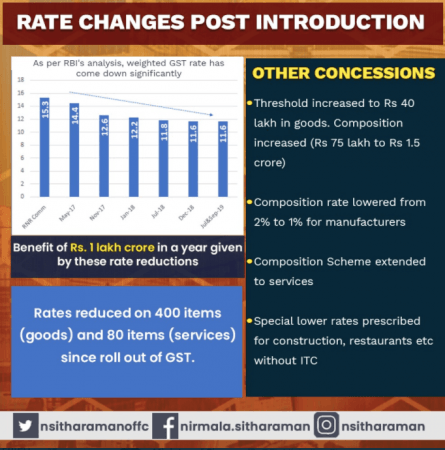

The ministry also said that now with GST the rate at which people need to pay taxes has come down significantly, "GST has reduced the rate at which people have to pay tax. The revenue-neutral rate as per the RNR Committee was 15.3%. Compared to this, the weighted GST rate at present, according to the RBI, is only 11.6%."

Furthermore, contradicting the criticisms against the GST implementation, the ministry has insisted that GST has made taxpayers more compliant. Moreover, it said that GST is 'taxpayer-friendly' in its outlook.

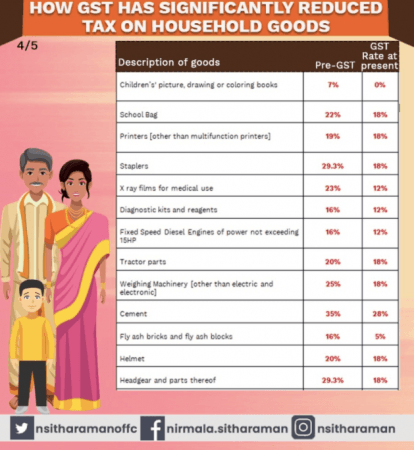

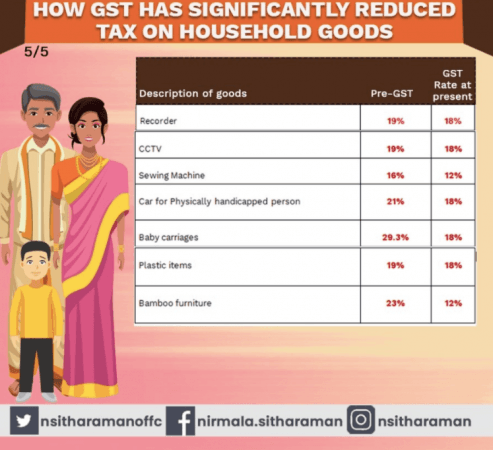

Comparison of pre-GST and GST tax rates

The ministry revealed about rate changes that, "Now, Businesses with an annual turnover of up to Rs 40 lakh are GST exempt. Initially, this limit was Rs 20 lakh. Additionally, those with a turnover up to Rs 1.5 crore can opt for the Composition Scheme and pay only 1% tax."

It also talked about the items that fall under higher tax slabs and how the 28% rate is restricted to sin and luxury items, "Out of a total of about 230 items in the 28% slab, about 200 items have been shifted to lower slabs." The GST has also brought relief to the construction sector the ministry said, "Significant relief has been extended to the construction sector, particularly the housing sector. It has now been placed at the 5% rate. GST on affordable housing has been reduced to 1%."

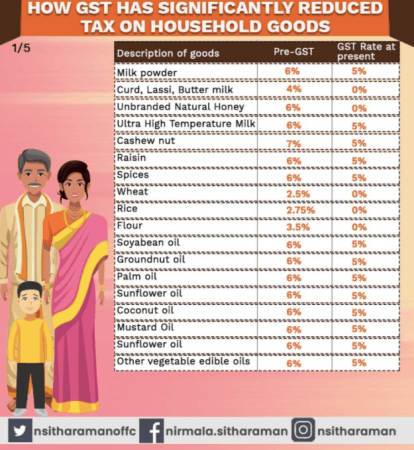

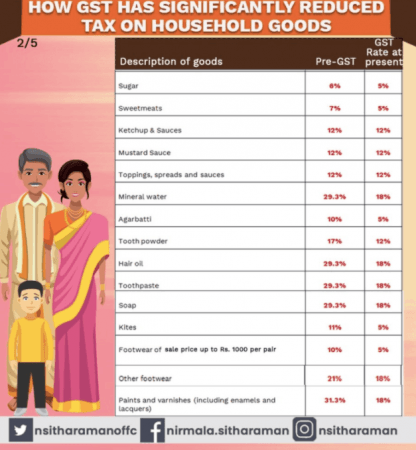

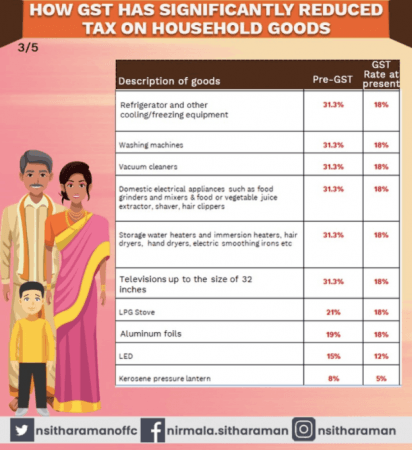

The ministry released a list of certain items showing the different between pre-GST and GST rates. Most daily use items have been brought under the 5% rate, while appliances saw a reduction from 31.3% to 18%.

Common-use items also saw a reduction from 29.3% to 18% under GST. Interestingly, cinema tickets came down from 35% to 110%, to 12% & 18% under GST.

The finance ministry revealed its concessions to the agricultural sector as well, "Substantial concessions have been extended to the agriculture sector in GST. On fertilisers, the net tax incidence was halved in GST. On agricultural machineries, the tax incidence has come down significantly from 15-18% to 12% and on certain items from about 8% to 5%."

Many are asking why certain items commonly used are required to have 5% tax levied on them such as oil and sugar. Moreover, items like soap and toothpaste both have an 18% GST levied on it.