Finance Minister Nirmala Sitharaman on Wednesday, May 13, changed the definition of micro, small and medium enterprises (MSMEs) as part of Rs 20 lakh crore Atma Nirbhar Bharat Abhiyan (self-reliant India) economic booster, announced by Prime Minister Narendra Modi on Tuesday evening.

Addressing a press conference in the national capital, FM Sitharaman said, "Definition of MSMEs is being changed in favour of MSMEs." This move will benefit a number of businesses in India and spur growth, which has been hit hard by the coronavirus-induced lockdown.

FM Sitharaman also stated the definition of MSMEs is changed because the low threshold limit in the earlier definition of MSMEs generated a "fear" among them that if they increase further, they may dodge the advantages that MSMEs take delight in. She also said this has been "killing the urge to expand" among the MSMEs, adding that this has been a long-pending request from the sector.

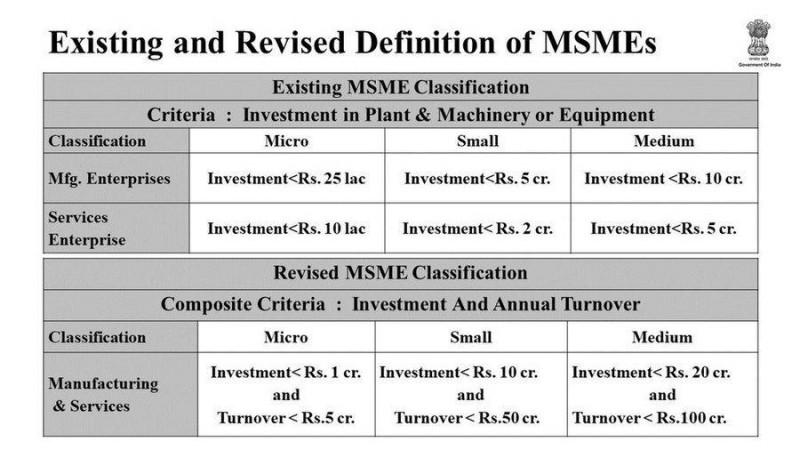

Also, the new definition of MSMEs does not differentiate between a manufacturing enterprise and a service sector enterprise, Sitharaman confirmed.

Investment limit revised

While providing details of the government's Rs 20 lakh crore economic relief package, the Finance Minister said the additional criteria of turnover has also been introduced for recognition of an MSME.

How the existing MSMEs is different from earlier:

As per the new changes, businesses with an investment of less than Rs 1 crore and a turnover of Rs 5 crore would be classified as micro-enterprises. Under the existing criteria, a company with an investment of less than Rs 25 lakh in the manufacturing sector and less than Rs 10 lakh in the services sector were considered micro-enterprises.

The investment limit of small enterprises has been increased to Rs 10 crore, and the companies would have to have a turnover of less than Rs 50 crore.

Further, the investment limit for medium enterprises has been increased to Rs 20 crore and the turnover limit has been kept at Rs 100 crore.

Sitharaman said that the necessary amendments to laws will be brought about to give effect to the changes.

Among other measures for MSMEs, she also announced a collateral-free automatic loan for businesses including MSMEs up to Rs 3 lakh crore.

Under the measure, borrowers with up to Rs 25 crore outstanding and Rs 100 crore turnover would be eligible for the special collateral-free loan.

(With agency inputs)