RBI approved a dividend of Rs 57,128 cr For FY21 and decided to maintain 5.5 percent of the expanded balance sheet as contingency risk reserve or retained earnings. How did RBI arrive at the numbers?

Latha Venkatesh from CNBC-TV18 explains the math behind the numbers of surplus earnings, reserve funds and income sources for the Reserve Bank of India (RBI).

RBI proves the budget estimate of Rs 89,000 crore wrong. How?

With RBI declaring its balance sheet earnings every week in its weekly supplement, the RBI balance sheet has expanded from Rs 41 lakh crore last year to around Rs 53 lakh crore this year. This shows an expansion of 12 lakh crore or around 30 percent this fiscal.

Of the Rs 12 lakh crore earnings, if RBI has decided to keep 5.5 percent as its contingency risk reserve fund then, the amount would be Rs 66,000 crore.

So if you took the same surplus of RBI as it made last year, which was Rs 1.23 lakh crore minus Rs 66,000 crore (which is 5.5 percent of the expanded balance sheet) then, you could easily arrive at an approximate of Rs 57,000 crore plus, and not Rs. 89,000 crore as the budget had earlier estimated.

How does the RBI's P&L work? What are the sources of income for RBI?

RBI's income comes from dollar sales. "It makes a lot of money from dollar sales, because if you see the historical purchase price numbers, it works to an average of Rs. 52 per US dollar, and every dollar is sold at around Rs. 75 per US dollar, so it makes a niche Rs 22 on every dollar sold," according to CNBC-TV18 report.

Besides this, the other source of income for RBI is interest earned on foreign currency reserves - approximately 530 billion dollars are invested in dollars or treasury bills. And as you know treasury bills are at negative or zero interest rates, which means this makes very little money for RBI, probably about just 1%.

Income from gold revaluation is a tidy amount this year. Also, revaluation of government bonds brings in some money, which is positive this year to be noted. As the yields fall, there is a rise in bond prices. Any fresh bonds purchased are called Seigniorage - as RBI prints the money which could approximately cost Rs 1000 crore.

What is seigniorage? "It is the cost of printing money, the difference between the face value of money, such as a $10 bill or a quarter coin, and the cost to produce it. If the seigniorage is positive, the government will make an economic profit; while a negative seigniorage will result in an economic loss," as clearly defined by the Investopedia.

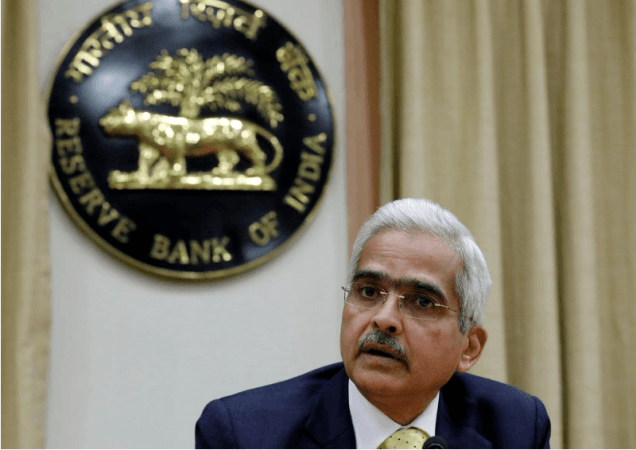

At the 584th meeting of the Central Board of the Reserve Bank of India (RBI) held today under the Chairmanship of Shaktikanta Das, Governor through video conference, a proposal for setting up of an Innovation Hub to mitigate the economic impact of Covid-19 pandemic was also being discussed.

"The purchase made by RBI in terms of bonds, the entire Open market operations (OMO) is mark-to-market gain and this accounts for the total revenues. The expenditure here is however minimal, which is mainly running expenses of the central bank (salaries and administration)."

Also, interest being paid on the reverse repo is huge. Everyday RBI absorbs approximately Rs 7 lakh crore and pays an interest rate of 3.35 percent as of August 14, 2020 on the reverse repo, according to the news report. Taking all this into consideration, the CNBC-TV18 report explains, "You can easily calculate the surplus RBI can make, which would approximate to Rs 1.2 lakh crore."