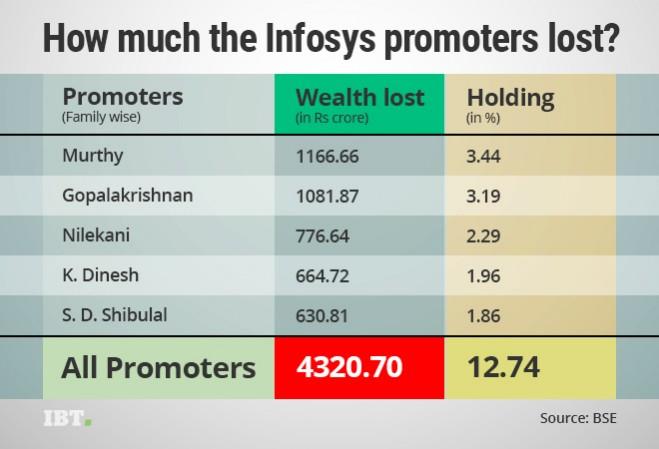

The promoters of the country's second largest IT company, Infosys, have lost around Rs 4,320.70 crore after Monday's trade, with co-founder N R Narayana Murthy losing the most. The Bangalore-based software company's stock plunged around 18 percent in two successive sessions, following the exit of chief executive officer (CEO) Vishal Sikka on Friday last week.

On Monday, the Infosys shares closed at Rs 873.50 on the Bombay Stock Exchange (BSE), down 5.37 percent from its previous close, lowest since August 2014.

In absolute terms, the software service exporter has lost Rs 33,914.71 crore of its market capitalisation as of Monday's closing, after sell-off was triggered Friday morning. The company's market value fell from Rs 2,34,554.78 crore on Thursday's close to Rs 2,00,640.07 crore at the close of Monday's trade on BSE.

The promoters of the Bangalore-based IT major hold 12.74 percent stake in the firm at the end of June 2017.

Former Infosys CEO and MD Kris Gopalakrishnan along with his wife Sudha Gopalakrishnan, lost about Rs 1,081.87 crore. Co-founder Narayana Murthy along with his wife Sudha Murthy and son Rohan Murty together held 3.44 percent of the company's stake, lost the most, amounting over Rs 1,166 crore since Friday's share price fall.

Another big name, Nandan Nilekani, who served as the CEO of the company between 2002 and 2007, lost Rs 776.64 crore as the Nilekani family holds 2.29 percent of Infosys's stake.

Sikka's relation with Murthy deteriorated over the past few months as the co-founder took his crusade against unsatisfactory corporate governance standards within the company.

"Dr Sikka's exit was the biggest risk and with this becoming an eventuality, the company faces a big challenge of filling the leadership vacuum. Dr Sikka had guided the company well at a time when the industry is undergoing a metamorphosis towards newer technologies," said analysts at Antique Stock Broking, as quoted by financial daily Business Standard on Monday.

After two sessions of continuous freefall, the shares of the company are back in the green on Tuesday trading at Rs 877.50 a piece, up 0.33 percent on BSE, as of 3:10 pm.