India's foreign exchange reserves rose $2.02 billion to $369.95 billion as of March 31, 2017, marking an increase of $10.20 billion since the commencement of the financial year. The reserves stood at $359.76 as of April 1, 2016, according to RBI updates.

The rise assumes significance in the context of three major events during the financial year that could have dented the country's forex reserves — demonetisation, the redemption of FCNR deposits that were issued in 2013 to stem rupee's fall and fears of capital flight due to the US Federal Reserve hiking interest rates.

India had raised about $25 billion by way of three-year FCNR deposits in September 2013 to overcome the sharp fall in its domestic currency. The deposits were due for redemption last year and was evident when the reserves fell $4.34 billion in the first week of October.

"Some $25 billion in foreign currency non-resident or FCNR (B) deposits raised to stabilize the rupee in 2013 will be maturing in Sep-Nov. About four-fifths of these deposits are unlikely to be rolled over, which in turn, could result in $20 billion in outflows. Expect some short-term impact on the balance of payments, strain on domestic liquidity conditions and a temporary bout of rupee volatility," Radhika Rao, economist, group research at DBS Bank had said in her June 10 note last year.

However, the country managed it without any major disruption to its reserves.

The next major macroeconomic shocker, so to speak, was Prime Minister Narendra Modi's decision to demonetise Rs 500 and Rs 1,000 notes on November 8 last year, triggering fears of an economic slowdown and consequent dollar outflows.

The equity inflows dropped from $6.19 billion in October to $4.67 billion next month and $3.34 billion in December 2016. Still, the overall FDI equity inflows rose 22 percent during April-December 2016 to $35.84 billion, compared to $29.44 billion in April-December 2015.

Another event that could have hit dollar inflows and thereby India's forex reserves was the decision by the US Federal Reserve to hike interest rate by 25 basis points on March 15.

On the positive side, the BJP's massive win in the Uttar Pradesh elections, the results of which were declared on March 11, fuelled a massive stock market rally driven by foreign investors. Inflows into debt market also saw a surge, resulting in reserves remaining stable and the rupee gaining strength.

March saw foreign investors buying Indian bonds in a big way. "Indian debt markets received Rs 272.6 billion of inflows in March (after Rs 57.2 billion in February), its highest monthly inflow in at least five years. Similar to February, inflows were driven by flows into central government debt. During the month, foreign investors increased their holdings of IGBs by Rs 175.8 billion (Rs 50.4 billion in February), the largest monthly increase in 30 months," Nomura analysts said in a note on Wednesday.

The domestic currency closed at 64.85 to the US dollar on March 31, 2017, a gain of 2.1 percent over the March 31, 2016 closing of 66.26. The rupee ended at 64.28 to the US dollar on Friday.

"Positive sentiment generated by good growth prospects of the Indian economy, sound macroeconomic fundamentals with low inflation, low current account deficit, adequate forex reserves, etc. are driving capital inflows contributing to the strengthening of the rupee," Arjun Ram Meghwal, Minister of State for Finance, said in a written reply to a question in the Lok Sabha on Friday.

The BSE Sensex fell 220 points to 29,707, while the NSE Nifty ended 64 points lower at 9,198. Top Sensex losers included Sun Pharma, Lupin, Adani Ports and Reliance Industries.

"There was profit booking which pulled down the market over half percent. Traders were booking profit on account of weak global cues, increased oil price and fall in USDINR. Geo-political factors pulled down market. Select Asian and European markets slipped after the news that the United States launched missiles at an airbase in Syria in response to Syrian forces' alleged use of chemical weapons," brokerage Motilal Oswal Securities said in a note on Friday evening.

Trading cues

The next week's trading on stock exchanges will be influenced by companies declaring their fourth quarter (Q4) and full-year results. Investors and analysts would be keenly tracking Infosys that will come up with it results on April 13. Management commentary will determine the trend not only for the company's share price but also for the entire IT pack and the stock markets as a whole.

The government may also declare the external trade data for March during the week. For the 11-month period endedFebruary 2017, India's exports had gained 2.52 percent to $245.41 billion YoY, raising hopes of ending the fiscal with $270 billion. Imports fell 3.67 percent to $340.69 billion.

Corporate updates

In a related update, the government said that the number of active foreign companies operating in India stood at 3,384 at the end of March 2017, with 1,484 registered in Delhi, followed by 823 in Maharashtra. The new registrations in 2016-17 rose to 161 from 149 in the previous fiscal and 157 in 2014-15.

The fund infusion into state-run banks in 2016-17 was Rs 24,997 crore, with the biggest share going to State Bank of India (Rs 5,681 crore), followed by Indian Overseas Bank (Rs 2,651 crore) and Punjab National Bank (Rs 2,112 crore).

India's share of the world economy was 2.83 percent, at $2.09 trillion GDP in 2015, the government said, citing World Bank statistics.

"According to the World Bank Group, assuming a simple linear extrapolation of growth rates and assuming India's GDP grows at 8% in US dollar terms, and France and the UK grow at 2.5% in US dollar terms, India's contribution to the global economy may surpass France in 2018 and the United Kingdom in 2021," Meghwal said in response to another query in the Lok Sabha on Friday.

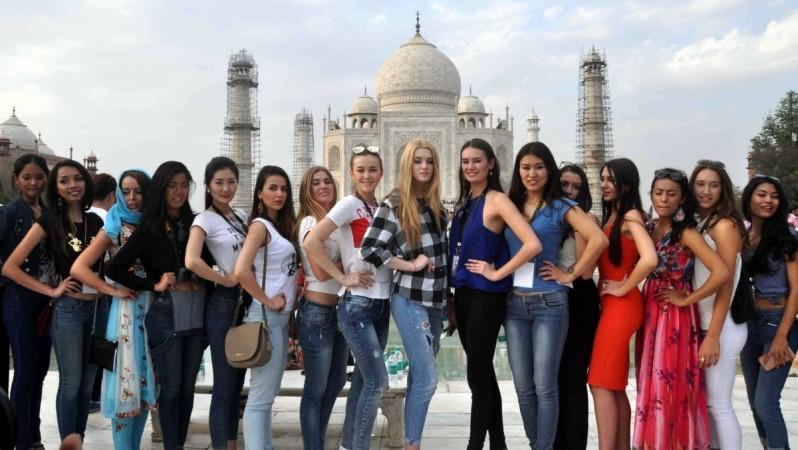

In yet another positive news, India jumped 12 spots to rank at No. 40 globally in the list of WEF's Global Travel and Tourism Competitiveness Report 2017.

"India continues to enrich its cultural resources, protecting more cultural sites and intangible expressions through UNESCO World Heritage lists, and via a greater digital presence," WEF said.

The report ranks 136 countries across 14 parameters, showing how countries could deliver benefits through their travel and tourism sector.