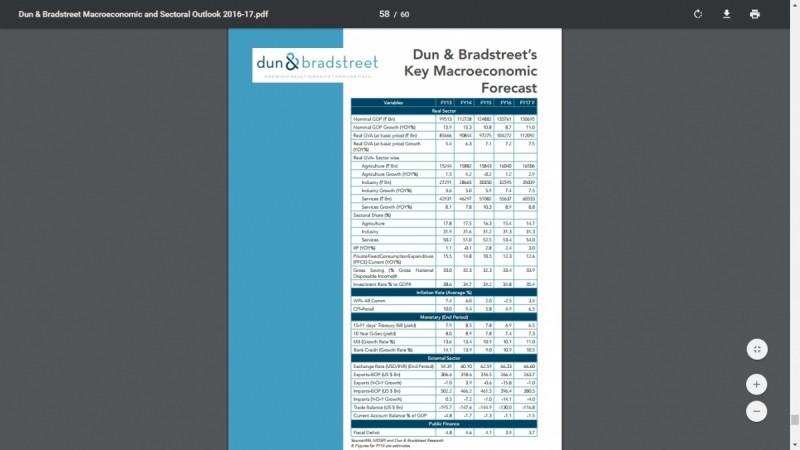

India's economy is likely to expand by 7.5 per cent on the back of consumption-led growth in the current financial year, a new report has forecast.

According to Dun & Bradstreet, growth in 2016-17 will be largely driven by low global crude oil prices, measures taken by the government to uplift rural demand, good agriculture production and the 7th Pay Commission payouts.

"In view of these positive developments and a normal monsoon so far, we expect India's economic growth as measured by GVA at basic prices to grow by 7.5 per cent in FY17 (2016-17) as against 7.2 per cent in the previous fiscal," said Arun Singh of Dun & Bradstreet India was quoted as saying by Financial Express.

"The resiliency of the domestic economy during FY16 amidst the fragile global economic scenario reveals that India is poised to curve its growth story driven by several steps taken by the government," he added.

The report also says that a better investment climate with improvements in ease of doing business through government reforms on foreign direct investment and clearance of Insolvency and Bankruptcy Code, GST and Debt Recovery Bill is expected to boost economic prospects. "The impact of these initiatives on economy will get reflected over a period of time," it added.

Dun & Bradstreet have also highlighted some key challenges that pose a few risks to the forecast.

For instance, the report highlights how the Indian corporate sector was exposed to profitability pressures and high debt burden in 2015-16. This vulnerability has translated into substantial deterioration in banking sector's asset quality. Non-revival in corporate investment could be a major hindrance to the resumption in the industrial activity.

Other challenges include:

• The stressed assets in the banking sector imply some impairment of the bank capital. This would adversely affect credit growth, particularly in Public Sector Banks.

• The implementation of the 7th Central pay Commission recommendations pose upside risk to the domestic inflation.

• Fragile and tepid recovery in some developed markets might dent external demand conditions.

• While it is expected that crude oil prices would stay at lower levels, geopolitical tension or sudden supply shocks may lead to sharp increase in global crude oil prices which in turn could waver the upright domestic growth momentum given the various direct or indirect linkages that crude oil has for the economy.