India's cement industry is likely to witness weak demand in the next financial year due to demonetisation-induced factors that would persist for a long period. To add to its woes, rising crude oil prices have the potential to hit profit of margins, making it a double-whammy.

"The demonetisation move by Indian government coupled with other policy measures are likely to impact the two pillars of cement demand in the country the most - housing and infrastructure. We believe the weakness in demand is likely to be spread over the long run compared to the current understanding of it being a short-term phenomenon," Mangesh Bhadang, analyst at brokerage Nirmal Bang, said in a note on Wednesday.

"We expect demand disruption to push down cement demand recovery by at least a year and hence capacity utilisation will be lower for a longer period than what was expected earlier," he added.

The industry is expected to be impacted not only by the slowdown caused by the cash crunch, but also the impasse over the Goods and Services Tax (GST) Bill and the regulatory legislation for the real estate sector (RERA).

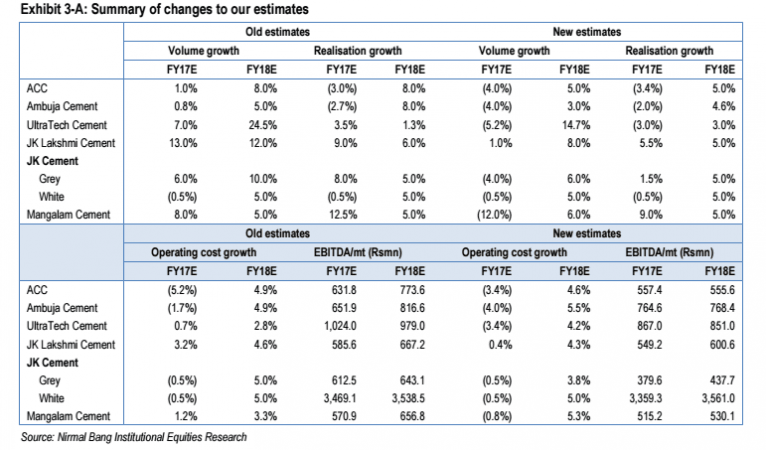

The impact, according to the analyst is phenomenal: from an estimate growth rate of 6 percent for the current fiscal made in September 2016, it now actually stands to a decline of 1.3 percent. Fiscal 2018 is likely to see a growth rate of 6.7 percent, making the years of high growth a thing of the past.

"We also believe that the golden period of demand growth witnessed between FY06 to FY10 is unlikely to be repeated in the near future," Bhadang wrote in his note.

Impact of rising crude oil prices

As if the domestic headwinds were not enough, the industry has also to contend with the end of low input costs, giving the trend of rising crude oil prices globally. "Cement companies' earnings were aided by softening of input prices over the past two years, predominantly coal/pet coke and freight rates through lower diesel prices. We believe that this period of decline in input costs is largely over as prices of various input products like international coal, pet coke and diesel are on the rise. With demand expected to be low, we believe that cost inflation will test pricing power in the industry," the analyst said.

Cement manufacturing companies in India include Ambuja Cement, ACC, Ultratech, JK Cement, Prism Cement and Shree Cements. India is the second-largest producer of cement in the world, after China.