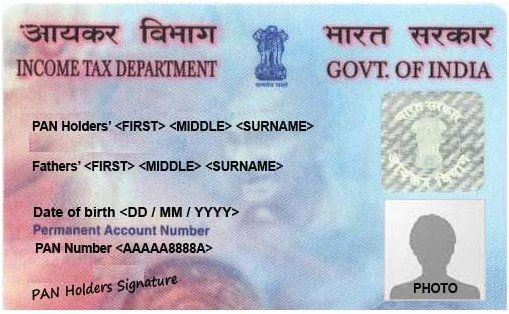

The Union Finance Ministry has asked all banks – both private and public sector – in India to ensure that they obtain the Permanent Account Numbers (PANs) or Form 60 of all the accounts they have, with the exception of Basic Savings Bank Deposit Accounts (BSBDAs). The banks have to provide this information to the ministry before February 28.

The ministry has said in a statement: "In this connection, it may be mentioned that the RBI vide circular dated December 15, 2016, has mandated that no withdrawal shall be allowed from the accounts having substantial credit balance or deposits if PAN or Form No 60 is not provided in respect of such accounts. Therefore, persons who are having bank account but have not submitted PAN or Form No 60 are advised to submit the PAN or Form No 60 to the bank by February 28, 2017."

Why are these details important?

There are two reasons why the finance ministry may be asking for these details. First, these would ensure that all bank accounts have been opened legally and there is no duplication of it anywhere. This will help root out accounts that may have been created illegally to hide black money.

Second, it will also give the government an idea of the income of an individual, and whether this tallies with the income that was claimed in the income tax returns forms. This could be an excellent indicator of if anyone had deposited black money in banks, or had had someone else's black money depisted in their bank accounts.

Why are BSBDAs exempt?

BSBDAs are essentially no-frill accounts, where although ATM cards and some other facilities are free, the maximum annual deposit is capped at Rs 1 lakh, and the maximum bank balance should not exceed Rs 50,000. These conditions make BSBDAs ill-suited for the needs of black-money holders who might want to launder their haul through the banking system.