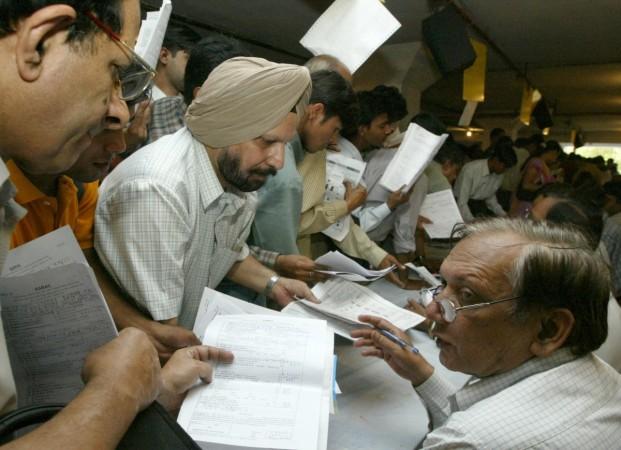

Filing Income Tax Returns (ITR) can be quite a hassle, with most tax payers leaving it for the last day. While the procedure may seem a tad long with numerous details and forms to fill and sort, the task has become much easier in the last few years, thanks to technology, through which ITR can be filed online.

As July 31, the last date to file ITR for individuals, draws near, here's how you can complete the procedure from the comforts of your home or office.

Register on the IT department's official website

To file the ITR online, one will need to register on the official website using Permanent Account Number (PAN) here. After opening the page, click on the "New to e-Filing? Register Yourself."

Select the user type, click on continue. On the next page fill in your PAN number, full name and date of birth to create an account. Once you create the account, you can login using user ID (same as PAN card number) and password.

Download e-File ITR

After logging in, one will be able to see the Downloads section on the right-hand side. Click on "Quick e-File ITR" link to download the form. There are eight types of ITR forms, so choose the one applicable to you.

ITR-1, ITR-2A and ITR-2 forms are for salaried individuals, while ITR-5 and ITR-6 forms are for companies.

Fill in your personal details

Fill in your personal details – your full name, PAN, address, date of birth, e-mail ID, mobile number, residential status, original or revised return and residential status – in the tax form. Keep saving the form at regular intervals after filling all the details.

Click on the "validate" button provided on all the sheets to confirm your details.

Income Details

Fill in your income.

Calculate Tax

The "Calculate Tax" tab will find out your tax liability. If you have paid more, then the balance amount will be credited to you, and if you have paid less then the remaining amount will be deducted from your account.

Generate XML file and upload returns

Click on "Generate XML" tab to generate an XML file, which will be saved in your system. Then, click on "Upload Return" under quick link menu.

Select the income tax return form, name and the assessment year. After you upload the form, the website will flash a message the return has been successfully uploaded and will provide you your transaction ID.

ITR-V

You will then receive an email "Confirmation on submission of IT Return" along with an acknowledgement number and an ITR-V.

Send ITR-V to income tax department

Download the PDF of the ITR-V form, take a printout, sign it with blue ink and send it to income tax department office, via Speed Post.

Acknowledgement of receipt of ITR-V

Once the income tax department receives the ITR-V, you will receive an SMS regarding the same.

!['Lip lock, pressure, pyaar': Vidya Balan- Pratik Gandhi shine in non-judgmental infidelity romcom Do Aur Do Pyaar [ Review]](https://data1.ibtimes.co.in/en/full/797104/lip-lock-pressure-pyaar-vidya-balan-pratik-gandhi-shine-non-judgmental-infidelity-romcom.jpg?w=220&h=138)