Demand for steel is expected to remain weak globally next year as a result of uncertainties arising out of persisting geopolitical challenges, aggravated by Britain's exit from the European Union (EU). The silver lining in the cloud is the buoyancy in Asian markets, excluding China.

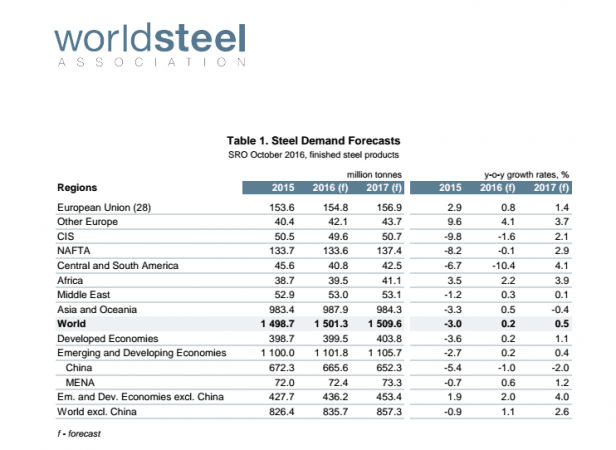

After a contraction of 3 percent in 2015, global steel demand is likely to increase 0.2 percent this year to 1,501 million tonnes (MT) and rise 0.5 percent 1,510 MT next year, says World Steel Association (WSA). The emerging and developing economies, except China, is expected to grow at a higher clip of 4 percent next year and 2 percent this year, it added.

The industry body that claims to represent members who have a combined 85 percent of total steel production worldwide, came out with the projections in its Short Range Outlook (SRO) for 2016 and 2017 released on Tuesday.

The sector will be a hostage to rising tensions worldwide, according to an expert at the WSA.

"The steel industry environment remains challenging, with escalated uncertainties driven by geopolitical situations in various parts of the world. Recently the UK referendum outcome has further raised uncertainty on the long-awaited recovery of investment in the EU," T.V. Narendran, chairman of the WSA's Economics Committee, said in the release.

The WSA said weakness in investment globally continues to hold back a stronger steel demand recovery.

"Investment is subdued in many regions, not only in China, which is undergoing a rebalancing away from investment driven growth. In the developed world, despite persistently low interest rates, private investment remains weak due to a pessimistic outlook on future demand and other continuing uncertainties," it said by way of explaining its projections.

India, a bright spot

The world's fastest-growing economy is expected to provide cushion to the industry, driven by its infra-expansion measures, though private investments are not so encouraging.

"Indian steel demand is expected to report solid growth in 2016-2017 backed by consumption-boosting reforms and infrastructure investment, but its sustainability is under question as key levels of investment are being provided by the government while private investment remains weak," the WSA said.

India is the third-largest producer of crude steel in the world, in addition to being the world's third-largest consumer of finished steel, according to the government of India.

Some of the leading steel companies in the country include Tata Steel, JSW, Steel Authority of India, Jindal Stainless and Uttam Galva Steels.

!['Lip lock, pressure, pyaar': Vidya Balan- Pratik Gandhi shine in non-judgmental infidelity romcom Do Aur Do Pyaar [ Review]](https://data1.ibtimes.co.in/en/full/797104/lip-lock-pressure-pyaar-vidya-balan-pratik-gandhi-shine-non-judgmental-infidelity-romcom.jpg?w=220&h=138)