Axis Bank, India's third-largest private sector lender, is likely to post a sharp fall in net profit on a year-on-year basis for the December quarter (Q3), according to a cross-section of analysts. During the November-December period last year, the bank was in the news for all the wrong reasons.

The Axis Bank stock was trading at Rs 451 on Wednesday at around 12.25 pm on the BSE; it has lost almost 11 percent from its November 9 closing of Rs 506.

Read: Axis Bank dismisses report of facing cancellation of banking license

IDBI Capital Markets & Securities is upfront in saying that the lender's asset quality woes are likely to extend into the third quarter (Q3) also. "...AXSB (Rating: SELL) in our coverage universe has had severe asset quality troubles and we expect the same to continue and get over by Q4FY17E," the brokerage wrote in a note.

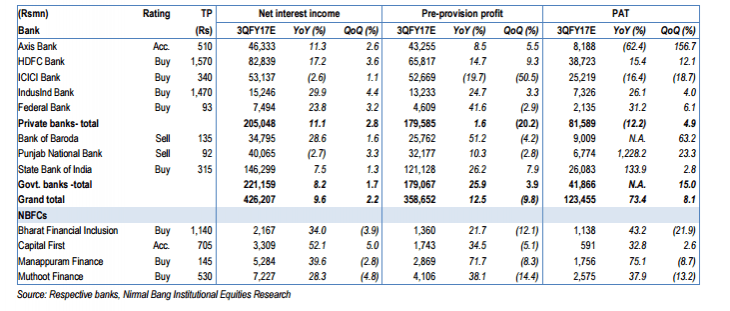

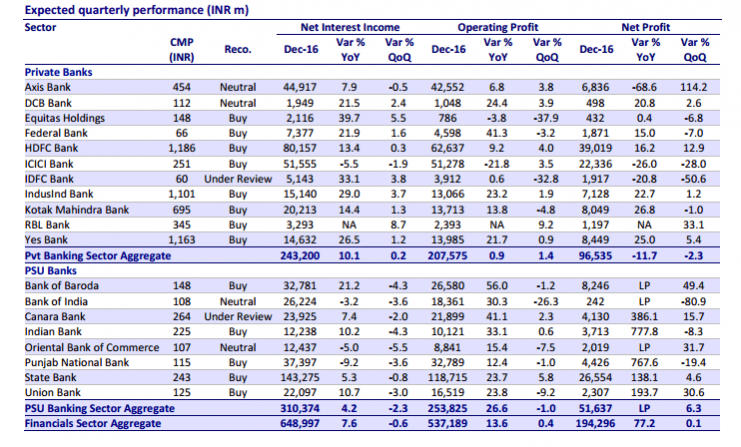

Motilal Oswal Securities Ltd. (MOSL) and Nirmal Bang Institutional Equities have also come up with their preview ahead of the bank's Q3 results scheduled to be announced on January 19.

Axis Bank is expected to post growth in its net interest income (NII) but net profit, or profit after tax (PAT) is likely to fall sharply, on a year-on-year (YoY) basis, according to the brokerages.

The December quarter is the first three-month period for banks that saw a surge in deposits in the wake of demonetisation even as credit growth remained weak for most of them.

Here are the estimates for Axis Bank's Q3 results by the three brokerages:

NII (Net interest income)

Likely to come at Rs 4,635.5 crore, an increase of 11.4 percent, YoY and 2.7 percent, sequentially, according to IDBI Capital Markets & Securities. Nirmal Bang has pegged it at Rs 4,633 crore, a growth of 11.3 percent, YoY and 2.6 percent, sequentially. MOSL has said that the figure would be Rs 4,491.7 crore.

PAT (Profit after tax)

Profit after tax likely to come at Rs 623.2 crore, down 71.4 percent, YoY and a rise of 95 percent, sequentially, IDBI Capital Markets & Securities said, while Nirmal Bang estimated PAT at Rs 818 crore, down 62.4 percent, YoY but an increase of 156.7 percent, sequentially. MOSL's estimate pegs net profit at Rs 683.6 crore, a fall of 68.6 percent, YoY.

PPP (Pre-provisioning profit)

Pre-provisioning profit (PPP) pegged at Rs 4,211 crore, translating into a growth of 5.7 percent, YoY and 2.7 percent, sequentially, according to IDBI Capital Markets & Securities. The estimates by Nirmal Bang are on the higher side, at Rs 4,325 crore, a growth of 8.5 percent, YoY and 5.5 percent, sequentially.

Some of the observations for banks in general, as part of the preview for Q3, FY2017 results

3QFY17 is a historic quarter for banks, with three defining trends (1) sharp uptick in CASA (expect at least 500bp QoQ rise in CASA) and digitisation drive, (2) massive flows to bond markets and sharp drop in yields (down ~30bp; difference between peak and low at 65bp), and (3) collapse in loan growth to a multi-year low – MOSL.

Demonetisation led to strong CASA inflows for the banking sector. Of the total INR15t+, we expect 30-40% to remain with the banking sector by end of FY17 - MOSL.

We expect NII to decline 2% QoQ (but grow 4% YoY) for state-owned banks, and grow 10% YoY (stable QoQ) for private sector banks. Weak loan growth, negative carry on old currency notes (until 10th December) and excess liquidity would impact margins – MOSL.

The large deposit inflow induced by currency exchange and the withdrawal curbs ensured banks overflowed with liquidity in the backdrop of muted credit demand and a likely weak credit demand outlook in near term – IDBI Capital Markets & Securities.

Though not of same scale and with different driving factors, the liquidity overflow was reminiscent of Q3FY09 when SBIN had an inflow of Rs732 bn in deposits while credit growth was just Rs109 bn in the same quarter (an incremental CD ratio of just 14.9%!) – IDBI Capital Markets & Securities.

NIMs are bound to weaken given the suddenly expanded base of IEAs (interest earning assets) while the incremental spreads remain obviously thinner due to deployment in short term instruments (MSS, Reverse Repo) – IDBI Capital Markets & Securities.

Overall profitability of the banking sector will be optically better in 3QFY17 on account of healthy treasury gains on its bond portfolio, very low base (AQR in 3QFY16) and relaxation by the Reserve Bank of India or RBI on asset quality – Nirmal Bang Institutional Equities.

Demonetisation has helped deposits to grow 15%, but at the same time credit growth has taken a further hit and decelerated to 5% – Nirmal Bang Institutional Equities.

Against the backdrop of slower economic recovery, higher debt leverage and muted credit growth, fresh loan slippage is seen at an elevated level, although lower than that of the previous quarter – Nirmal Bang Institutional Equities.